In its earliest days, artificial intelligence (AI) was thought of as a dead-end technology, an invention that would never be adopted or used to its highest potential. As recent history tells us, that couldn’t be farther from the truth.

Today, AI technologies are reshaping the way businesses operate across industries. In ours, AI in insurance is helping insurance companies keep up with customer demands, operating requirements, and competitors.

But how exactly do AI and insurance work together?

AI in the Insurance Industry

To understand how insurers can best utilize the capabilities of AI, you must first look at the expectations of a modern consumer. Everything today must be fast, but it must also be authentically personal.

Humanizing the experience is the new status quo and AI is uniquely adapted to deliver a more humanized experience across the entire insurance lifecycle. With AI in the insurance industry, insurers can create unique experiences for customers looking to buy or renew property and casualty insurance.

Everything from claims management to underwriting to data analysis can be impacted, streamlined, and optimized to improve customer service and internal operations.

AI is revolutionizing the insurance sector, transforming it from a futuristic concept to an industry-wide trend. According to a report by Grand View Research, the global market for artificial intelligence reached a staggering USD 136.55 billion in 2022 and is projected to maintain a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030. This remarkable growth highlights the immense potential and impact of AI in reshaping the insurance industry.

A report from PwC forecasted that AI’s initial impact will primarily relate to improving efficiencies and automating existing customer-facing underwriting and claims processes. Over time, its impact will be more far-reaching; it can identify, assess, and underwrite emerging risks and identify new revenue sources, impacting nearly every aspect of the P&C insurance industry.

See Also: Watch our webinar to learn more about how the Duck Creek Platform enables AI and chatbots for insurers.

How to Maximize the Impact of AI on Insurance Operations

Before diving into the specifics of how to maximize the impact of AI on insurance operations, let’s take a moment to understand the enormous potential this advanced technology holds. From automating mundane tasks to assisting in complex decision-making processes, AI has the power to revolutionize the insurance industry.

By integrating AI into their operations, insurers can deliver faster, more personalized service, improve risk assessment, and streamline claim processing. Let’s explore how insurance providers can fully leverage this transformative technology to their advantage.

1. Leverage AI to Standardize Underwriting & Risk Assessment

The underwriting process depends on data management and analysis, a process traditionally overseen by people. With the advent of AI, the analysis of underwriting criteria can be processed faster, integrating data from multiple sources and generating accurate pricing results and risk assessments. And with an open platform that uses predictive intelligence to improve risk selection and pricing, carriers can deliver customer experiences that are fast, easy, intuitive, and ethical.

This is not to say that the human element is entirely removed from the underwriting process – just the opposite. Reports created with AI can inform underwriters and their decision-making processes, making their jobs easier and their analyses more accurate. AI in insurance impacts many areas of the underwriting process, but most importantly, pricing.

AI can help underwriters look at current and past risk levels and pricing guidelines that correlate. Using historical data, AI can generate risk management steps and then monitor policies and insureds during the time of coverage. This can improve claims costs and relationships with customers, and ultimately helps P&C insurers more accurately price policies within an appropriate window, without “leaving money on the table.”

2. Reimagine What Claims Do

Claims have historically been a drawn-out process. And when a customer is forced to file a claim due to injury or property damage, the last thing they want to do is deal with multiple points of contact.

This is where AI can help. It can enable insurers to better serve customers in their times of need. Claims processing software powered by AI can process claims, assign an agent, assess coverage levels, create follow-up tasks, and stay in contact with the customer throughout the claims process.

This reduces cycle times and gets customers the help they need quickly, improving their relationships with their insurers and their insurers’ reputations in the market. AI is also being used to combat a huge money pit in insurance – fraudulent claims. Intelligent systems can spot irregularities or patterns in data and help insurers improve the accuracy of fraud detection.

3. Use Data-Driven Personalization to Develop New Business

Artificial intelligence humanized and personalized experience to customers without any initial human interaction. Using client-generated data and AI algorithms, insurers can offer best-fit policies to prospective customers based on their unique requirements.

Gartner anticipated that by 2023, over 33% of major organizations will have analysts specializing in decision intelligence, utilizing contextual data to enhance their decision-making processes.

AI can even recommend coverage levels based on previous customer interactions or buying behaviors of customers who fit similar profiles. The burden of identifying the optimal product is no longer solely on an agent, and is instead heavily supported by massive amounts of data that could only be processed using artificial intelligence.

See Also: Learn more about how Duck Creek personalizes experiences across the policy lifecycle for policyshoppers, underwriters, and claimants.

4. Innovate the Customer Experience with Data

AI can also help insurers prevent attrition or lapses with their current customers. These efforts all start and end with data – on customers, their behaviors, and their risk for letting their policies lapse.

AI can process data that insurers have collected as well as data outside of their systems. Social media information, demographics, purchase history, environmental factors, and more can all paint a picture about a customer. Algorithms can use this data to identify customers in need of attention and enable insurers to focus on re-engagement campaigns targeting that customer set.

Then, using AI, you can launch a re-engagement campaign that contacts customers through their channel(s) of choice and when they’d be most receptive to contact. AI engagement for customers can be optimized and used to select proper channels, appropriate products, targeting, and timing of messaging to be most effective.

5. Turn Customer Insights into Meaningful Marketing

To stay competitive in the insurance industry, insurers have to develop new products frequently. However, that effort is all for nothing if the products don’t sell, making marketing efforts vital to success. Similar to retention efforts, AI can also inform marketing efforts to target customers most effectively.

According to the EY 2024 Global Insurance Outlook report, an estimated 43% of worldwide insurance firms plan to employ AI and data science approaches for forecasting patterns and customer demands. The primary aim is to better cater to client requirements and enhance operational efficiency.

AI data can be used to develop profiles for customer groups, which marketers can then use to inform and direct their strategies. AI can also monitor leads as they work their way through the sales funnel – from awareness to interest to decision to action – and direct targeted marketing efforts to these potential customers at each stage in the process.

6. Transform While You Perform

AI in insurance can improve all facets of policy administration, underwriting, billing, and customer relations, but it should also be used to improve the internal operations of insurers themselves.

As per an analysis by Accenture, about 40% of incoming calls in the claims department are just to check the status of claims. Leveraging AI, insurers can proactively send out status updates, which enhances customer experience and also leads to operational efficiency by reducing the volume of inbound calls.

AI makes insurers more efficient. Customers can be contacted and serviced at a higher volume and higher speed, saving insurers money and creating happier customers. It can also speed up claims processing by automating decision-making processes and getting customers the money they need.

7. Reinvent Workers’ Compensation With SaaS Solutions

With SaaS-based workers’ compensation insurance software, carriers can more easily leverage both machine learning and AI to assess risk in real time and ultimately make more accurate and efficient decisions. This enhanced insight also allows insurers to provide more customer-friendly product options, such as pay-as-you-go pricing.

With a better worker’s compensation insurance program comes the data, compliance, and medical reports that organizations need to take care of customers while still providing the flexibility required for today’s operations. And, these solutions have the AI and data capabilities to scale up as demand requires.

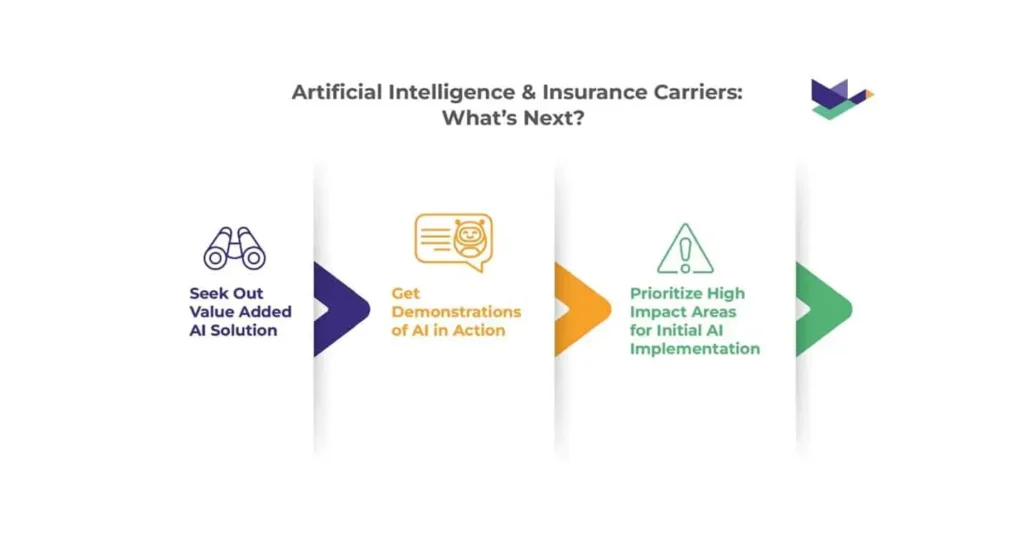

Artificial Intelligence & Insurance Carriers: What’s Next?

With this information in hand, you should conduct an internal assessment of these functions, and decide where adding AI would have the most impact on your insurance operations. Once obvious improvement areas are identified, the next, and arguably most crucial step, is finding a partner to help you get started.

During this search, there are some best practices that will help ensure a more seamless transition:

Seek Out Value-Added AI Solutions

Highly consider insurtech vendors within your platform provider’s ecosystem that offer AI solutions with added value. These vendors are likely to have a more in-depth understanding of your specific needs and context. They can provide AI solutions tailored to your operational challenges, which can significantly improve your operational efficiency and customer service.

Get Demonstrations of AI in Action

Before committing to any AI technology, ensure you have a clear understanding of its functionality and potential impact on your operations. Request demonstrations of the AI systems in action. This will provide you with a tangible sense of how the technology works and how it can be integrated into your current operations. It’s an essential step to ensure that the AI solution aligns with your operational objectives and customer service goals.

Prioritize High Impact Areas for Initial AI Implementation

A wholesale shift to AI may not be feasible or advisable for every insurer. Instead, consider starting with areas where adding AI capabilities will deliver the most impact in the shortest timeframe. This targeted approach allows you to see quicker returns on your investment and can provide valuable lessons for more extensive AI implementation down the line. The savings and positive results from your initial AI implementation can then be reinvested into subsequent upgrades.

Artificial Intelligence & Customer Experience

All of the aforementioned areas of the insurance industry that can be improved by AI – underwriting, claims, new business, retention, marketing, and operational efficiencies – are aimed at improving the experience for customers. At the end of the day, customer satisfaction is the primary value-add of AI in insurance.

Customers expect to be a priority before, during, and after the sales process, a level of attention that would exhaust nearly every resource for insurers. With AI in insurance customer service, companies can attend to every need of their customers at the speed and frequency that is required.

To be successful, AI depends on one resource – arguably the most important resource for P&C insurers – data. And for insurers to successfully utilize the power of AI, they need a data analytics solution that can collect, analyze, manage, and report on the data they’re collecting every second. Once a proper solution is in place, AI software can be put to work, automatically leveraging data to help insurers make the best decisions for their businesses.

4 Generative AI Best Practices and Use Cases to Ensure Positive Impact in Insurance

When discussing the role of AI in the future of insurance, Generative AI (GenAI) is also an up and coming topic. With GenAI becoming more and more relevant after the first release of ChatGPT in 2023, insurers are also taking the first steps to ensure proper adoption of this technology into their day to day operations.

Adopting a tailored strategy becomes imperative for insurers looking to drive innovation within their company with GenAI. This section outlines four best practices insurers can follow to proactively and strategically approach innovation and transformation.

By assessing their current technology landscape, envisioning future goals, implementing structured change, and fostering an environment of continuous learning and improvement, insurers can effectively leverage GenAI and other emerging technologies.

These best practices serve as a roadmap, guiding insurers through the nuanced process of adapting to and thriving in a rapidly evolving technological and regulatory environment.

1. Assessing the Current State and Readiness

Insurers need to assess their current state and readiness for using GenAI and other technologies, and to identify their strengths, weaknesses, opportunities, and threats, and their gaps, challenges, and risks. Insurers can use various frameworks and tools to conduct their assessment, such as the GenAI Maturity Model, the GenAI Readiness Index, or the GenAI Risk Assessment.

2. Defining the Future State and Vision

Insurers need to define their future state and vision for using GenAI and other technologies, and to set their objectives, targets, and indicators, and their priorities, initiatives, and actions. Insurers can use various frameworks and tools to define their future state and vision, such as the GenAI Strategy Map, the GenAI Value Proposition, or the GenAI Roadmap.

3. Implementing the Change and Transformation

Insurers need to implement their change and transformation for using GenAI and other technologies, and to execute their plans, projects, and programs, and to monitor, evaluate, and control their progress, performance, and outcomes. Insurers can use various frameworks and tools to implement their change and transformation, such as the GenAI Change Management, the GenAI Project Management, or the GenAI Performance Management.

4. Learning and Improving Continuously

Insurers need to learn and improve continuously from their use of GenAI and other technologies, and to capture and share their knowledge, experience, and feedback, and to incorporate their lessons learned, best practices, and recommendations. Insurers can use various frameworks and tools to learn and improve continuously, such as the GenAI Learning Cycle, the GenAI Knowledge Management, or the GenAI Feedback Loop.

Adapting to Change: Strategic Pathways for Insurers in the GenAI Era

The P&C and general insurance market is facing unprecedented changes and challenges, as well as new opportunities and incentives, due to the emergence of GenAI and other technologies and the evolving regulatory landscape. Insurers need to navigate the regulatory changes and trends, and to leverage GenAI and other technologies, to create competitive advantages and deliver value to their customers and stakeholders.

Insurers can adopt a proactive and strategic approach to regulatory compliance and innovation, and to use various frameworks and tools to guide and support their use of GenAI and other technologies.

By doing so, insurers can enhance their performance, efficiency, and profitability, as well as their customer satisfaction, loyalty, and retention, and their social responsibility and reputation, and they can become more agile, adaptive, and resilient in the face of the regulatory changes and trends.