Trusted By

Policy Simplified

As an insurer, you need a policy management solution that not only addresses current challenges but positions you for future growth and innovation.

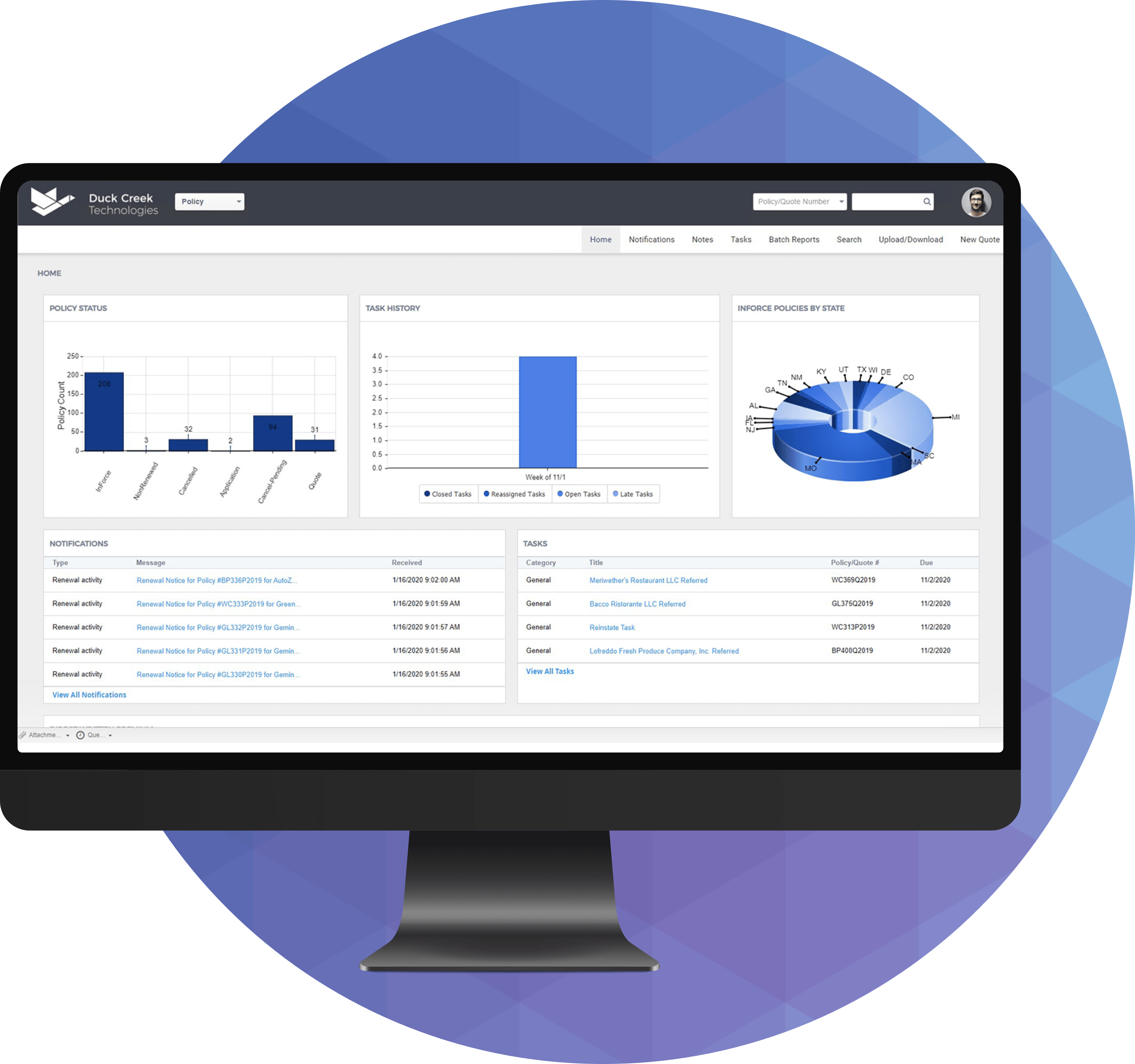

Duck Creek Policy offers an agile, comprehensive, and scalable solution enabling insurers to meet the personalized needs of modern consumers and deliver exceptional experiences. With its robust configuration features, you can tailor policies to fit the specific needs of your customers, enhancing satisfaction and loyalty.

Why Duck Creek Policy

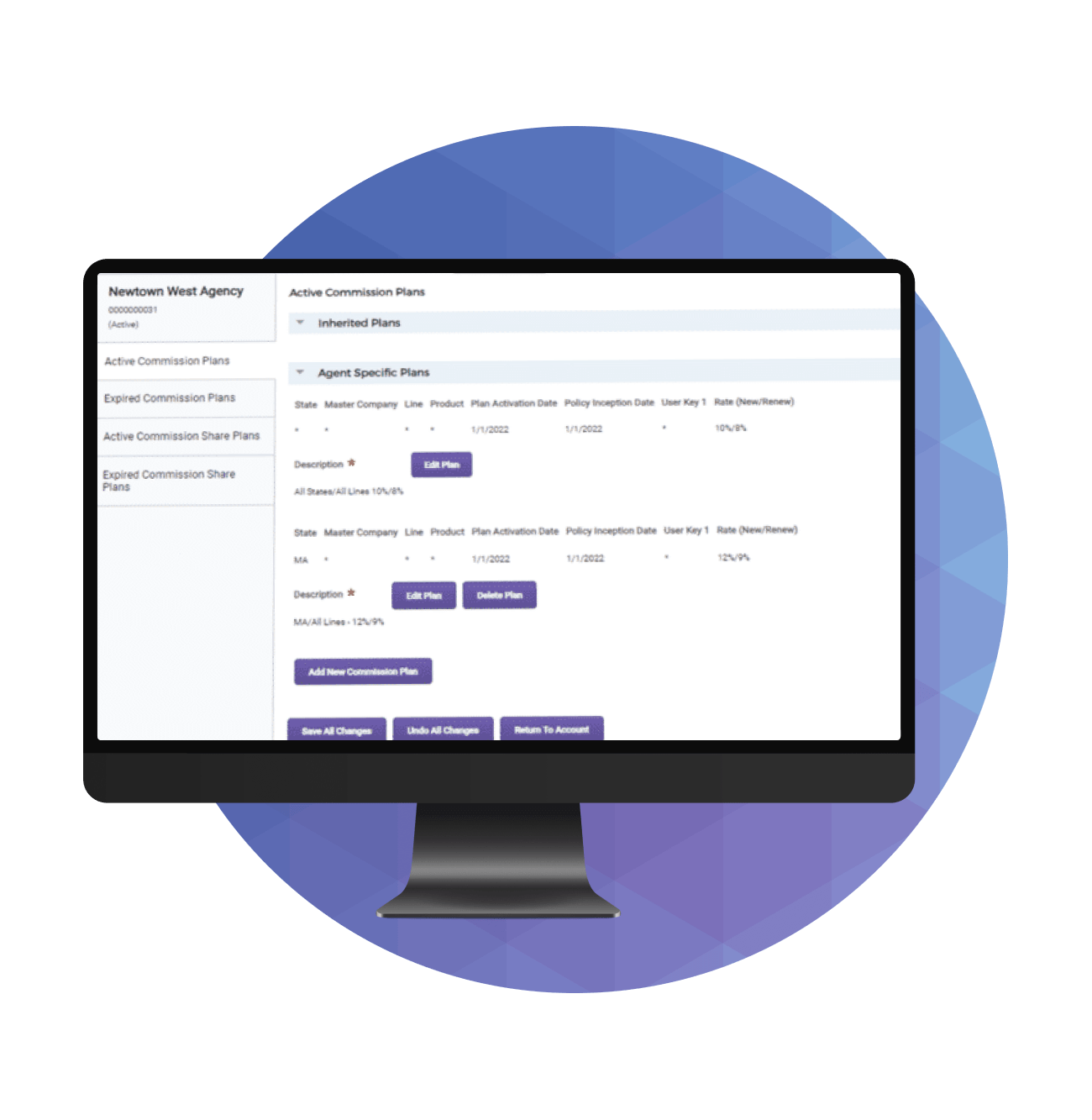

Flexible & Configurable

Essential features for insurers adapting to constantly evolving consumer preferences and regulatory environments.

Integrated Rating & Forms

Simplified product support with a state-of-the-art rating solution and forms engine, purpose-built into our configuration tools.

Product Architecture

Configure a product once, and reuse or inherit product definitions to rapidly launch new products.

Looking for help? Lets chat!

Trusted, Reliable SaaS Policy System

70%

Reduction in time to update rates and factors

50K+

Number of transactions processed per day

5

Seconds to produce tailored quotes; in-force policies in 5 minutes

Key Features

What Our Customers Say

“We chose Duck Creek because of the low-code configurability of the system. That’s something that’s very important to us. The developers are able to quickly implement changes without changing code.”

Blair Sturts

Senior Vice President Information Technology, Cumberland Mutual.

What Analysts Say About Duck Creek

Duck Creek named a luminary in Celent Policy Administration System Vendors North America Property Casualty Insurance, 2023.

Duck Creek Policy offers insurers a full set of features and functions, deployable in Azure, with a growing ecosystem of solutions and implementation partners.

Donald Light, Director P&C Insurance, Celent

Source: Duck Creek Technologies; March 22, 2023; Duck Creek Earns Three XCelent Awards from Celent

Partner Ecosystem Integrations

Discover the comprehensive partner ecosystem that Duck Creek Policy offers, featuring numerous integrations with technology providers specializing in different policy lifecycle use cases.

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.