Welcome To The CreekPeek – Duck Creek’s April 2024 Release Highlights!

Discover innovative feature updates, watch video highlights, and stay ahead with our continuous release information for the Duck Creek Suite.

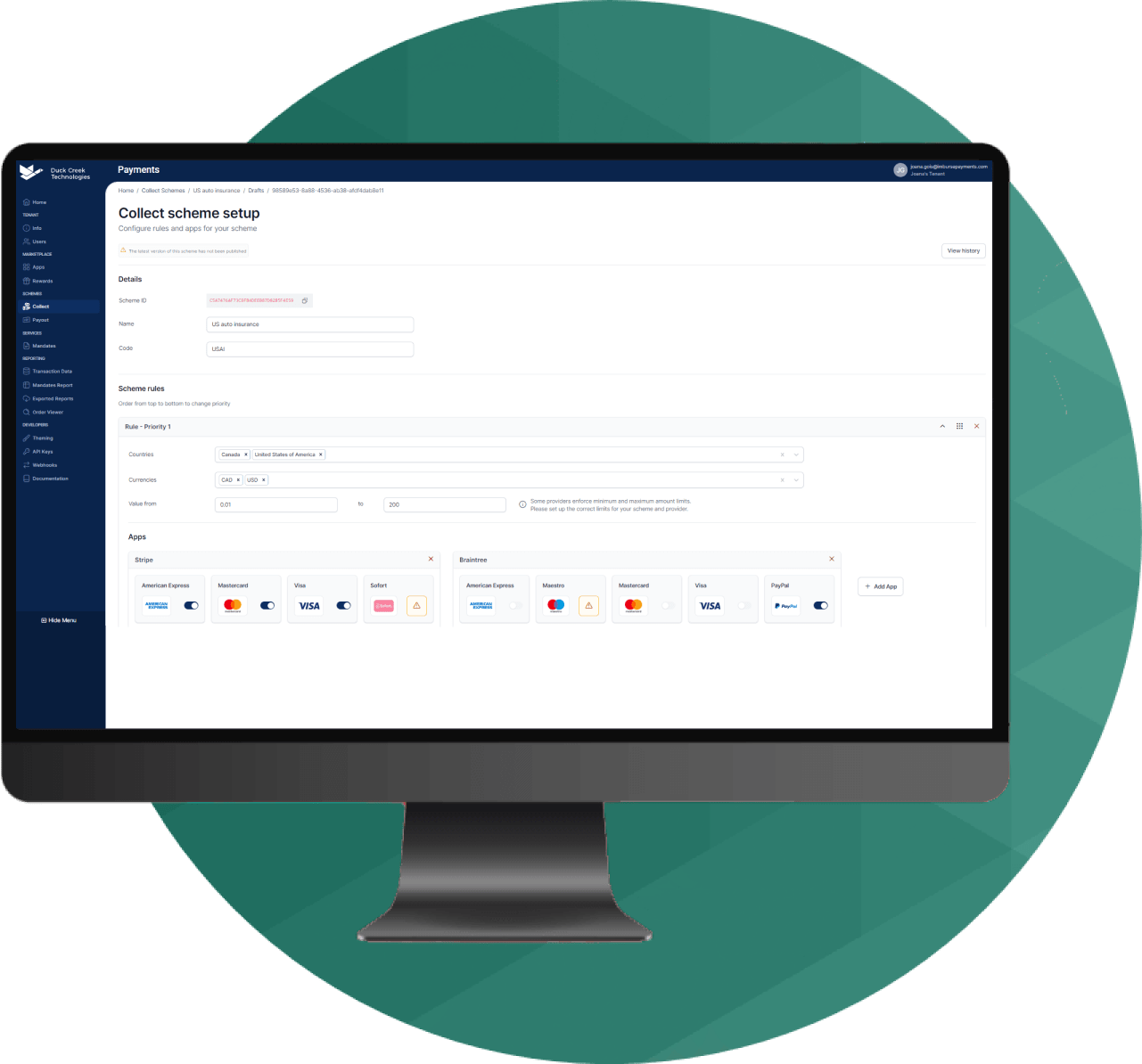

Duck Creek Payments is Here!

Want to learn how to constantly delight your customers?

It begins with deploying the right payment solution for each market swiftly and seamlessly. Watch this Product Launch replay to learn how to revolutionize your payment processes for collections and payouts.

The Importance of Payments for Insurers with Bernhard Schneider of PwC

Listen as we explore how critical payments is to the overall insurance value chain, why insurers struggle to comprehend how much they are even spending on the payments capabilities they provide, and discuss the potential savings insurers can extract from a next generation payments setup.

Dive Deeper With our Highlight Reels

Enhance your understanding of our latest feature updates.

Configuration Studio

Learn how to build remarkable experiences and innovative products with Duck Creek Configuration Studio, now available for Controlled Availability.

Underwriting Persona

Bring multiple parties, quotes/policies, billing accounts, and claims together to support account-level underwriting, performer assignment and more using Duck Creek Underwriting Persona.

Duck Creek Policyholder

Announcing the General Availability of Duck Creek Policyholder, enabling P&C carriers to deliver valuable and satisfying portal experiences that result in delighted customers.

The Duck Creek Innovator Webinar Series

Join us as we celebrate the brilliance of innovators within the Duck Creek Community spotlighting our Hatch-a-Thon 2023 finalists.

Click the links below to access these on-demand webinar replays to learn how these innovations redefine the landscape of insurance excellence and show what can be built on Duck Creek!

Coforge

Our 2023 Hatch-a-Thon winners solution empowers customers with easy access to their documents instantly on WhatsApp.

ValueMomentum

ValueMomentum, a 2023 Hatch-a-Thon finalist showcases their Cognitive Underwriter Virtual Assistant (CUVA) to streamline underwriting analysis quickly and efficiently through cognitive conversational collaboration.

Xceedance

Xceedance, a 2023 Hatch-a-Thon finalist highlights their project, SmartAgent.AI. SmartAgent.AI provides customers with effortless and personalized insurance servicing via WhatsApp, utilizing AI/ML, ChatGPT, and Duck Creek capabilities.

The spirit of innovation is alive and well!

Our 2024 Hatch-a-Thon will feature new and innovative solutions designed to Simplify the Complexity in insurance. We are excited for you to visit our finalists in the Launchpad at Formation 2024, where attendees vote to decide the winner!

At-a-Glance: Innovations Across the Board

Explore our latest product enhancements, designed to empower insurers with advanced tools and features.

Billing

- Active Delivery – Billing Conformance Requirements Documentation

Enables current clients to understand the work that is needed for them to be eligible for Active Delivery migration. This document covers how to handle their customized DB, CBO, and manuscript tech debt. This helps the Upgrade / Migration / Implementation teams know where clients still need to remediate and helps provide a path forward so they can correct them.

Claims

- Front End/Back End Formatting Enhancements deliver valuable enhancements prioritizing usability and internationalization in our development process, ensuring our products meet diverse customer needs. This approach enhances user experience, builds trust, and increases satisfaction, directly contributing to customer success and expanding our global reach.

- Policy Refresh creates a more efficient overall claims experience by streamlining the claims handling process, reducing the number of duplicate claims, manual data entry, and ensuring accurate policy-to-claim associations.

- CamCom AI Damage Assessment and Cost Estimation Integration (Claims) The integration of CAMCOM’s Visual Inspection Platform with Duck Creek Claims introduces a more streamlined and impactful method for conducting vehicle inspections within the insurance claims ecosystem.

- Smart Communications SmartCOMM™ Integration (Claims) This Anywhere Enabled Integration (AEI) for Duck Creek Claims allows personalized and compliant multi-channel/multi-language documents to be generated quickly without having to leave the Duck Creek Platform – such as Sworn statement generated during the Claims FNOL process.

- Verisk MSP Navigator Section 111 Reporting Solution (Claims) Verisk’s proprietary platform MSP Navigator is integrated with Duck Creek Claims and delivers real-time responses that guides users through prompt and accurate Section 111 reporting.

Clarity

- Non-Duck Creek Data can be brought into Clarity empowering our customers to join data from their Duck Creek Suite of products with other insurance related data, whether that is legacy system data or vendor data, so that they can analyze trends and optimize business decisions. A Duck Creek process seamlessly combines Non-Duck data with Duck Creek sourced data within pre-built Power BI reports enabling customers to unify their data for more robust analysis and decision-making.

- Duck Creek Machine Learning Integration

Commercial Lines Compliance

- Total circulars released – 221

- Extended Auto Coverage: The new ISO Standard Class Plan is now available in 16 additional states consolidating the OCP plan and Standard plan manuals, offering wider protection for your auto insurance needs.

- Inland Marine Coverage: Nationwide coverage with tailored rules, rates, and forms.

- Business Owner’s Policy Enhancements: Including PFAS, Cyber, and Data Privacy coverage now extended to 35 states.

- Improved User Experience: Introducing new features like maximum limit indicators for General Liability class codes and streamlined forms processing for large schedules.

- Crime Coverage Updates: Introducing new Insuring Agreements in Crime, enhancing protection against specialized risks.

- CR0409 (Feb): Focused on Lessees of Safe Deposit Boxes, providing added security for your valuable assets.

- CR0410 (March): Catering to Securities Deposited with Others, ensuring your investments are safeguarded.

- Streamlined Auto Processing: In ISO and Mass Auto, relocating Plate Number/Registrant details to the risk level simplifies data management and enhances operational efficiency.

Digital Engagement – Policyholder & Producer

- Enhancement of Policyholder Day 2 Transactions for Additional Interest. US Personal Auto and Homeowner policyholders can view, add, edit, & remove additional interests on their personal auto & homeowner’s policies via the self-service portal.

- Single Quote Table enables underwriters, producers, and policyholders to collaborate in real time when customers use our Policy system.

- Turnstile Support for new forms & form editions.

Distribution Management

- Distribution Management Data to Duck Creek Clarity will provide data downstream in a raw (bronze) format to Clarity. Our customers want to be able to access their DM data with improved velocity and variety.

- Store and Access NIPR Login and DB using Azure Key Vault The NIPR and DB credentials are stored securely using the Azure key vault to record and access DB, increasing the ease of use and enhancing efficiency.

- Performance Improvements for PDB Utility minimizing maintenance window for large NIPR PDB imports / updates

International Product

- India Country Layer – Drop II builds on the current Indian Country Layer to include additional features for GST, Endorsements, Refunds, Co-Insurance, Reinsurance, and GSTIN. Enhancing our existing readiness for the Indian Insurance Market.

- Updates to existing International Product Content Packages to be compatible with Duck Creek Policy Active Delivery including:

- Australia & New Zealand Base updates for Policy & Billing

- NZ Personal Home Suite LOB Kit

- NZ Personal Motor Suite LOB Kit

- India Country Layer Base

- Know Your Customer (KYC) Framework provides for accelerated speed to go live by enabling a framework that aids mandatory Know Your Customer processes in India. This will not only support the regulatory requirement but also enhance the overall user experience for our Indian customers.

OnDemand Workstation (ODW) & Control Hub (ODCH)

- Custom Deployment Enhancements. Providing the ability to perform self-service deployments for Active Delivery products in ODCH will ensure reduced dependency on DCOD Release Management team and provide more control to customers to manage their customized deployments.

- Localization and Internationalization to support ODCH in global markets.

- Report Enhancements and UI Improvements Making UI enhancements and providing new reports will improve end user experience for internal DCT teams and OnDemand customers and will help in increasing the adoption of ODCH.

- ODW support for Active Delivery: Automation to created image with latest released product versions.

Payments

- Customer Vault 2.0

Agreements, Compliance for the US Market - ACH

Disbursements and premium collections in the US - Card Acceptance

Premium collections in the US via credit/debit cards - Bank of America

- Allow insurers to collect premiums and disburse claims payments with BoA as their ODFI (Originating Depository Financial Institution).

Policy

- Policy Anywhere Managed Integrations can be deployed in an automated fashion with each Active Delivery release.

- Newgen CCM Integration (Policy) The Newgen CCM Integration for Duck Creek Policy provides the ability to create policy templates and allows business users to generate and review policy documents before sharing with customers and archiving in Newgen’s ECM repository.

- Newgen OmniDocs WorkDesk ECM. The Newgen – Duck Creek ECM integration allows Duck Creek users to manage the entire policy documents life cycle. Documents can be viewed in a single unified viewer including image and non-image documents. In addition, policy documents can be edited through merge and extract features.

- Planck Commercial Lines Data Prefill (Policy) The Planck Integration package provides users with a prefill integration with Duck Creek Policy and their Planck service. Out of the box, this integration will prefill account, location, and NAICS code information.

- Verisk Motor Vehicle Reports (Policy) This Anywhere Enabled Integration for Verisk Motor Vehicle Reports simplifies integration by tapping into a single, robust platform, leveraging scalable technologies, and harnessing cloud-based connectivity to develop smarter, more agile workflows.

Platform

- Duck Creek Rating Performance Measurement, iterating on our performance profiling work to assess the performance impact of development at each code check in, specifically for Rating.

Reinsurance

- AAD / AAL Condition on Facultative XL Contract – Completion of the facultative calculation.

- LORS – Collection Note – Finalization of the USM allocation // Automation of the collection note report in the LORS context.

- LAE Per Policies The method to calculate the Loss Adjustment Expense is defined per reinsurance contract. This feature will allow the user to follow the LAE calculation on the direct policy instead of the reinsurance one.

- LORS – Additional Modifications Integration with London market.

- MAOL Ability to automatically apply the MAOL (Maximum Any One Life) clause on eligible claims/aggregates.

- Shared Limit Ability to have a limit on an event across two different contracts.

Release Resources

Tailored resources to help you understand our product updates better.

For Insurers

Access release notes, FAQs, and more to make the most of our latest updates.

For Developers

Dive into technical documentation and code samples to seamlessly integrate our new features into your systems.

- Clarity:

Clarity Release Notes – December 2023 through February 2024 - eBook – Payments:

Duck Creek Payments Lexicon of Payment Terms

For Media

Get the scoop on our latest updates and innovations through press releases, media kits, and more.

- Duck Creek in the News:

Verisk Expands Ecosystem Adding Section 111 Reporting Platform to Duck Creek Content Exchange - Press Release:

Core Specialty Leads the Way in Innovation with Duck Creek Solutions via Microsoft Azure Marketplace

Explore Past Innovation

Our commitment to continuous innovation enables P&C insurers to work smarter and more efficiently. Delve into our previous product updates for a look at our evolutionary journey.

Product Updates Announcement Q1 2024

- Global-Ready Claims Support with expanded capabilities for additional out-of-the-box support for supported countries:

- The new Geography Configuration tool allows you to easily add and customize geography formats.

- Translation empowers users to add their languages to the application, enhancing usability and internationalization while reducing the need for reactive remediation in diverse scenarios.

- Enhanced Performance to continually elevate quality, performance, and stability.

- Internationalization of the Suite supporting front-end and back-end formatting applicable to our target markets.

- Duck Creek Clarity General Availability for Data Access and Curated Data for Claims, Billing, and Policy.

- Distribution Management Data in Clarity Bronze for raw data access.

- Auto – rollout of 7 states.

- Inland Marine for rules, rates, forms – 50 states.

- BOP – PFAS, Cyber & Data Privacy – 35 states.

- Improvements to Templates

- Workers’ Compensation, Commercial Auto, Businessowners.

- Improved User Experience

- General Liability – Add the maximum limit for class codes and a message to indicate when the user enters an exposure value greater than the ISO maximum.

- Forms Performance Improvements for Large Schedule policies.

- WC Forms – adding signature block for electronic signatures (400+ forms).

- WC – Setting up print job in alphabetical order by state to be consistent with other LOBs.

Digital Engagement – Policyholder & Producer

- Turnstile Support for new forms & form editions.

- Record and access DB & NIPR Credentials securely using Azure Key Vault.

- We’re enhancing our data feed how we connect with carriers & other systems, making it easier to retrieve & manage data through Clarity.

- Send advance notices to your agents prior to terminating their appointments with NIPR following the state rules using our enhanced Compliance Solution.

International Product

- Completion of Indian Country Layer for Suite Enablement.

- Adoption of Policy Active Delivery and upgrade to Clarity for India Country Content.

- Updates to Coverage Factory across International regions to enable competitive design of Insurance Products for innovative insurers.

OnDemand Workstation (ODW) & Control Hub (ODCH)

- Improved Log Access capability in ODCH to include application logs for all three security domains with improved performance.

- Enhancing the self-service custom deployment capability for Active Delivery products by providing ability to update and manage customer variables as part of the custom deployment request process.

- Cumulative Monthly Maintenance Releases include the availability of release artifacts that enables users to self-serve and deploy HFs/releases independently on workstations.

- Multi Factor Authentication enabled for new and existing labs.

- Self Service Deployment support for Active Delivery products.

- Bank of New Zealand

Allow carrier to collect premiums by card and BECS DD in NZ. In addition, allow them to disburse claim payments to NZ bank accounts. - Faster Payments

Allow carrier to disburse claims payments instantly to UK Bank accounts. - SEPA Instant Credit Transfer

Allow carrier to disburse claims payments instantly to European Bank accounts.

- Release Underwriter Persona for Policy Active Delivery (Controlled Availability) Enabling the creation of Underwriting Accounts from sets of Policies, assignment of Performers, and pages providing a 360-degree view.

- Configuration Studio Controlled Availability of our low code web-based tooling, continuing to round out feature functionality for parity with Author.

- MAOL

(Maximum Any One Life) – Application of the Maximum Any One Life on claims and aggregates - Policy Conditions

Supports the definition of Loss Adjusting Expense (LAE) conditions at policy level. - Shared Limit

Ability to have a limit on an event across two different contracts. - AAL/AAD for Facultative

Automation of the management of Annual Aggregate Deductible and Annual Aggregate Limit for Facultative covers. - London Market connectivity to the LORS system – Stabilization and client testing in partnership with DXC + reporting part.

- Policy & Claim retrocession enables following a policy and claim across the reinsurance journey, to determine the final exposure based on original references.

- Policy Conditions enables the application of policy-specific conditions instead of the reinsurance contract conditions (cession and commission rates for QS and Deductible for XL).

Product Updates Announcement Q4 2023

- PDB Alerts Dashboard enabling carriers to monitor & visualize the updates received via alerts. Detailed reporting available on the alerts consumed for troubleshooting.

- Onboarding Workflow enhancements to the current agent onboarding process by adding additional email notifications & configurations to automate & streamline the process. Added configurability to the agent onboarding process reducing the agent onboarding timeframe.

- Enhancing the Compliance workflow by implementing additional state rules required to process NIPR appointments.

Industry Content / Bureau Templates

- Commercial Lines Compliance

- Continued Performance Improvements to Templates

- Workers’ Compensation, Commercial Auto, Businessowners.

- Enhanced Policy Curated Data leveraging best-in-class SnowflakeTM platform to store & access data. (Controlled Availability)

- Easy, insightful reporting through Power BI

- Enhanced Billing Curated Data leveraging best-in-class SnowflakeTM platform to store and access data. (Controlled Availability)

- Easy, insightful reporting through Power BI

International

- Launch of Indian Country Layer providing out of the box enablement for the Indian market considering cultural nuances, locale, currency and time/date formatting. This enables teams to accelerate implementation and provides the basis for future Indian market enablement

- Enhancement to provider management with Australian General Insurance Panel Provider and Loss Adjuster Workflows

Ondemand Workstation (Odw) & Control Hub (Odch)

- Cumulative Monthly Maintenance Releases include the availability of release artifacts that enables users to self-serve and deploy HFs/releases independently on workstations.

- Multi Factor Authentication enabled for new and existing labs.

- Self Service Deployment support for Active Delivery products.

- Duck Creek introduces Policy Active Delivery (General Availability) ending policy upgrades and eliminating technical debt.

- Bank of New Zealand

Integration allows carriers to collect premiums by card and BECS in NZ - Faster Payments

Allow carrier to disburse claims payments instantly to UK Bank accounts. - SEPA Instant Credit Transfer

Allow carrier to disburse claims payments instantly to European Bank accounts.

- London Market connectivity to the LORS system – Stabilization and client testing in partnership with DXC + reporting part

- Policy and Claim retrocession enables following a policy and claim across the reinsurance journey, to determine the final exposure based on original references.

- Policy Conditions enables the application of policy-specific conditions instead of the reinsurance contract conditions (cession and commission rates for QS & Deductible for XL)

Product Updates Announcement Q3 2023

- Translation empowers users to add their languages to the application, enhancing usability and internationalization while reducing the need for reactive remediation in diverse scenarios.

- Released Accessibility Enhancements for Producer

- Turnstile Support for new forms & form editions

- Rapid Bulk Uploading of New Prospects directly through the UI removing dependency on the manual process

- A new PPRM Dashboard with reporting that empowers field reps to track and monitor agency performance against goals using production data

International Content

- With the release of the AU Commercial General Liability Line of Business Kit, we have now completed all full-suite base level Line of Business Kits for the Australian Market

- Introducing New Zealand Personal Home LOB Kit launchpad workflows, and full integration to Duck Creek core solutions including integration with EQC

- Deployed new marketplace integration to National Australia Bank’s Direct Link to allow merchant account holders to collect premiums & pay claims by BECS AU interbank network.

- Deployed new integration to the National Australia Bank Gateway, allowing merchants to accept premiums by way of card.

- Deployed new marketplace integration to the Bank of New Zealand’s Gateway product to allow BNZ merchant account holders to collect premiums by way of card.

- Add Twint as a payment method to the Worldline Saferpay gateway to allow merchant account holders to accept premiums by Twint

- Commercial Lines Compliance – Property – Rules & Loss Cost Revision for EQ/Volcanic Eruption & Commercial Auto – continued rollout of 9 states

- Improved User Experience – Rewrite of WC Audit Statement for all states, the Addition of Crime CR0408 and Audit functionality added to Mass Auto

- Significant Performance Improvements in Workers’ Compensation for Large Schedule Policies

- Claims Curated Data in Controlled Availability – Leveraging best-in-class SnowflakeTM platform to store and access data

- Why it’s impactful: Easy, insightful reporting through Power BI; Increased volume of data; Increased variety of data

OnDemand – Control Hub & Workstations

- Multifactor Authentication (MFA) enabled as part of ODW lab provisioning

- Theme Maker Utility, Worker, Consumer and Agent theme assets included in ODW

- ODCH support for Distribution Management – Extending Control Hub capabilities to encompass self-service deployments for Distribution Management (DM) application

- DataFix Enhancements for improving processing and workflow by replacing output queue in DataFix processor with storage container

- Party Configuration for Enabling Searching & Job Auditing now allows customers to configure partial party searching and extension points for Organization Entities, catering to international customer needs and establishing an audit trail on Job Title

- Policy Active Delivery (Controlled Availability) ending policy upgrades and dramatically reducing technical debt for carriers. Policy Active Delivery includes silent updates for performance, security & aligned issue resolution. Policy Active Delivery includes rapid new feature adoption with feature flag identification & introduction

- Policy Active Delivery Training – The following training is available at Duck Creek University for customers and partners:

- POL-OND-110 POLICY ONDEMAND PRODUCT OVERVIEW

- POL-OND-200 POLICY ONDEMAND IMPLEMENTATION BEST PRACTICES

- STE-OND-101 DUCK CREEK ONDEMAND OVERVIEW

- STE-OND-120 ONDEMAND CONTINUOUS UPDATES

- STE-OND-205 ONDEMAND FEATURE FLAGS

- STE-OND-310 DUCK CREEK ARCHITECTURE PREPAREDNESS

(Available in Duck Creek University Now! Contact your CSM for additional information.)

- London Market Connectivity to the Lloyd’s Outwards Reinsurance System. It will also be possible to finalize the transactions by receiving or sending the actual payment.

- Inuring Review enables the ability to allow all types of links between all types of contracts.

- Australian Compliance Enhancement with the addition of the APRA indicator.

Product Updates Announcement Q2 2023

- New user experience for Distribution Management personas

- Streamlined process for third party integration with APIs for Agency Inquiry

Industry Content / Bureau Templates

- Commercial Lines Compliance – Countrywide circulars for Auto and General Liability

- Property Business Income Rating – added average base rate weighted by floor area

- Enhanced Claims curated data leveraging SnowflakeTM

- Greater customer data access from Policy, Billing, Claims (Controlled Availability)

International

- Launched Small Medium Employer (SME) Commercial Motor for Australia

- Introduced up-to-date Spanish Policy Base ensuring compliance with local standards

- Configuration enablement minimizes duplicate records by uniquely identifying repeat customers entries

- Manuscript engine optimization for large schedule processing

- Duck Creek introduces Policy Active Delivery (Controlled Availability) ending policy upgrades and eliminating technical debt.

- Added Policyholder Day 2 Transactions for Personal Auto & Contact Information

Keep Up with the Future of Insurtech

Stay ahead of the curve with updates on our upcoming feature releases. Sign up now.