Payment Processing for Insurance

Duck Creek Payments Facilitator is an embedded payment processing platform that integrates directly within the Duck Creek ecosystem, offering insurers a secure and compliant way to accept payments from policyholders and make claims disbursement as needed.

With our advanced solution, insurers reduce operational friction, boost security, access real-time payment data, enable cross-border transactions, and significantly cut costs.

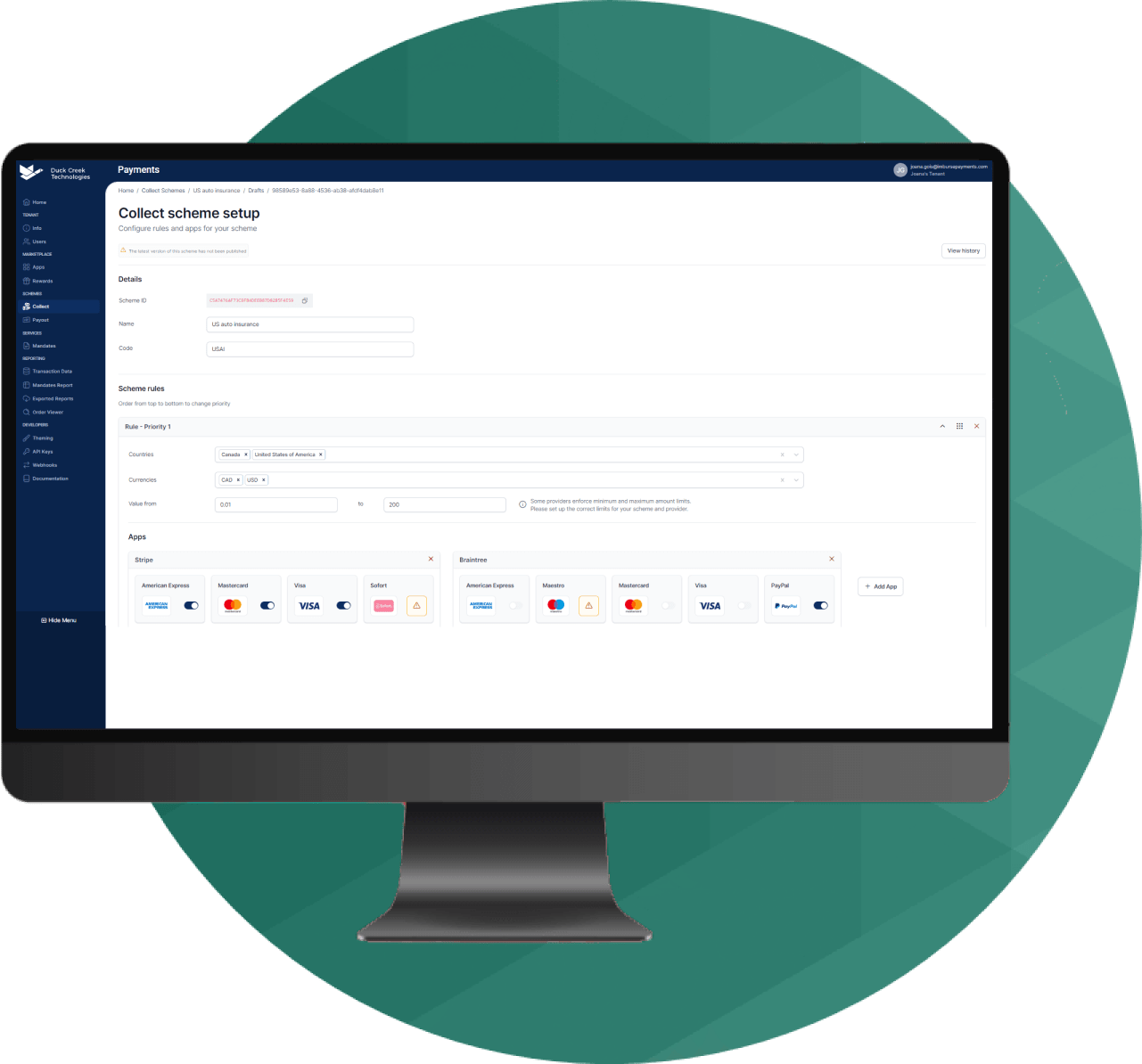

Payment Orchestration for Insurers

Connecting to various payment services can be complex and costly for insurers, often limiting access to the full benefits of the global payments ecosystem.

Duck Creek Payments Orchestrator eliminates these barriers by providing a single, streamlined connection to a wide array of payment technologies and providers worldwide. Whether for collections or payouts, insurers can seamlessly access global payment networks, regardless of their current IT infrastructure.

We handle the complexities so you can focus on what matters.

Payments. Simplified

Why Duck Creek Payments?

Reduce cost and engage fewer resources

Duck Creek Payments does all the heavy lifting, from converting file formats and building capabilities and workflows, to integrating technologies, connecting providers, and reporting on transactions all in one place.

Accelerate speed to market

Through one integrated platform for payments, you have access to all capabilities, technologies, and providers, off the shelf. Your enterprise can access your chosen providers in a matter of minutes.

Future-Proof payment capabilities

Future-proof your business through a seamless integration with diverse payment providers, enabling scalability, flexibility, and enhanced customer experiences. Easily adapt to evolving payment trends and regulatory requirements, ensuring long-term growth and efficiency.

Streamline Operations with a Single Contract

Through one single contract, insurers an access a variety of digital payment capabilities for both collections and payouts.

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.