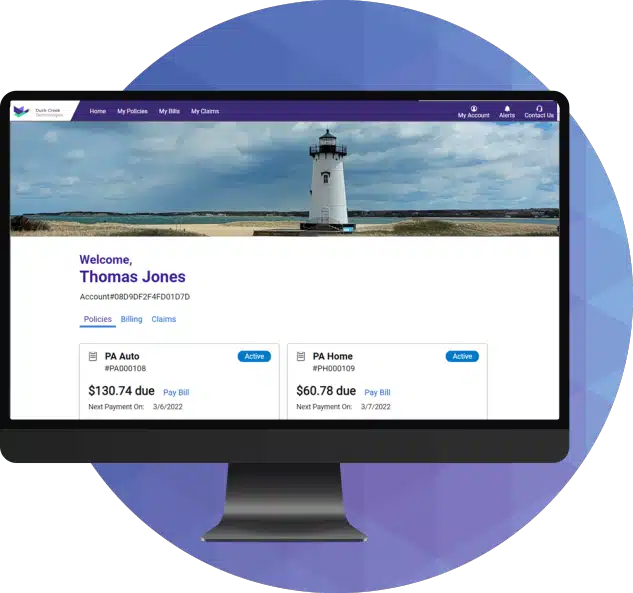

Policyholder Simplified

Duck Creek Policyholder enables P&C carriers to deliver valuable and satisfying portal experiences that result in delighted customers.

Designed with extensive persona based UX research, accessibility compliance and industry standards, Duck Creek Policyholder provides a single, seamless policyholder experience that’s accessible from anywhere, on any device, at any time.

Duck Creek Policyholder enables carriers to capitalize on the policyholder experience, ensuring customer satisfaction and leading to customer loyalty and retention.

Why Duck Creek Policyholder?

Easy-to-Use Workflows

Reduce call center volume, reduce expenses, and increase customer satisfaction with intuitive, easy-to-use interfaces.

Modern, Mobile-First Design

Meet customer expectations for self-service and 24/7/365 availability with an OOTB responsive design and accessibility compliance.

Single Point of Change

Increase innovation investments by leveraging our low-code platform and dynamic SaaS solution to eliminate dual maintenance of policy systems.

Insurers’ Go-to Policyholder

80%

of critical customer service questions addressed on one screen

100+

EFT payments processed per second

2K+

Invoices generated per minute

*US Homeowners and US Personal Auto only

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an ala carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery TM, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.

Ask a Question

Whether you’re launching a Greenfield initiative, changing providers, or looking to make a digital transformation, our multi-faceted team of insurance and technology experts can help get you there.