With cloud technology, insurers are completing core systems replacement projects and achieving digital transformation in months, not years, freeing resources to improve the customer experience and streamline internal processes.

The P&C insurance industry has crossed a threshold. The majority of insurance core systems sold since 2015 were cloud-based or hosted rather than implemented on premise, according to research from Strategy Meets Action, a strategic advisory services firm serving the insurance industry. This has critical implications for insurers who have taken a wait-and-see approach to digital transformation, chiefly: The gap between insurers that are digitally enabled from the core and those that are not is accelerating. It’s no longer a question of whether to replace core legacy systems. It’s about how.

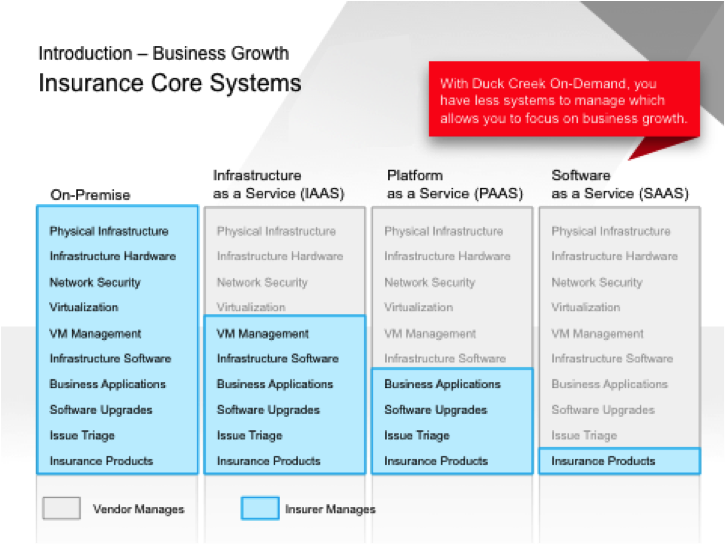

Many insurers—and especially small-to-medium carriers and those with smaller pools of tech talent to draw from—are effectively leapfrogging the competition by transitioning to a Software as a Service model for their core systems.

Cloud is Now a Mature Technology

“When looking across insurance, cloud is now mainstream. In our last quarter, use of our cloud close to doubled year-over-year, and we saw new cloud case studies from several insurers of various sizes and across business lines,” says Tony Jacob, managing director, Worldwide Insurance at Microsoft. “Carriers, brokers and reinsurers are moving multiple workloads to the cloud, not only for IT cost reduction, but more for digital transformation and agility.”

By 2020, worldwide spending on cloud will climb to $203.4 billion from $122.5 billion this year, Jacob adds, citing the International Data Corporation’s “Worldwide Semiannual Public Cloud Services Spending Guide,” released in February 2017. Plus cloud spending overall will experience compound annual growth of a 21.5%—nearly seven times the rate of overall IT spending growth. “Insurance will be one of the top industries driving that spending,” Jacob adds.

Businesses’ willingness to embrace SaaS has always hinged on their comfort with security, and that’s particularly true for insurers. But as cloud providers have increased investment in security and scalability over the past three or so years—Microsoft alone invests more than a billion dollars a year in security research and development—customers and prospects come away highly confident in the hyper-scale cloud and our Duck Creek On-Demand model. Many tell us that we are more secure than what they already have, which is reflected in the numbers.

Regardless of industry, the main reason behind this astounding adoption rate, I believe, is speed to market. Assuming you select the right provider, some insurers are completing digital transformation projects in months, not years. And insurers launching new products, territories, or segments in the cloud—whether IT augmentation or so-called “green field” opportunities—are going into production even faster.

Contrast that with implementing a core system on premise. Just standing up a core system can take months, which costs real money and delays the projected benefits. Plus, because the technology is always evolving, maintenance and upgrades are time-consuming and can have unexpected consequences for downstream systems, which can be a serious disincentive to innovation.

In a mature SaaS environment, where the provider manages maintenance, upgrades, and integrations, those problems evaporate, and insurers reap the rewards of digital transformation almost immediately.

SaaS is Democratizing Digital Transformation

Good technology has a democratizing effect on business. It enables the largest number of users to more quickly and dramatically improve their work output because it minimizes barriers such as cost structures, complexity, and clumsy interfaces. The best users—meaning the ones with the most experience, intuition or creativity—optimize their results by discovering or devising new opportunities to increase their productivity. That’s one of the promises of digital transformation.

Digital transformation is now baked into customers’ expectations. The Altimeter Group, an independent research and strategy consulting firm focused on disruptive technology trends, defines it as the “realignment of or investment in new technology, business models, and processes to drive value for customers and employees and more effectively compete in an ever-changing digital economy.”

In “The 2016 State of Digital Transformation,” released in September of that year, Altimeter surveyed 528 digital transformation leaders and strategists across industries and asked them to rank the priorities driving their digital transformation projects. The results will look surprisingly familiar to insurers:

- Evolving customer behaviors and preferences (55 percent)

- Growth opportunities in new markets (53 percent)

- Increased competitive pressure (49 percent)

- New standards in regulatory and compliance (42 percent)

A more surprising trend is Altimeter’s finding that digital transformation projects are being led largely not by the CIO/CTO (just 19 percent), but rather by chief marketing officers (34 percent); CEOs (27 percent); chief digital officers (15 percent) and chief experience officers (5 percent).

The implication is that digital transformation is being driven by concerns around revenue, retention, and the customer experience more than by technology. I believe the reason is that digital technology—at its best—lowers barriers to entry. It’s easy for end users to adopt and adapt via configuration, not code. And through the cloud, IT is now available as an operational expense rather than capital expense.

For CIOs, the implication is that vision and the ability to innovate are becoming more valuable than the ability to run a data center. For other CXOs, the implications are that you are no longer tied to legacy systems and that there are real financial and operational benefits to be realized in the best SaaS models.

Cloud Simplifies Integrations and Maintenance

In our experience, and as verified by the analysts, medium and small carriers increasingly are buying insurance core system suites or multiple components. The reasoning behind this trend is pretty straightforward: Replacing a policy, billing, claims or rating system likely will reveal the limitations of older components and the integrations between them.

With that in mind, it’s often easier to upgrade with multiple pre-integrated components rather than recreate the integrations to aging or inflexible applications. But there’s another compelling reason: it reduces risk, especially with the continuing consolidation among smaller vendors in the insurance technology space.

“Insurers are trying to simplify integration and do not want technology to be an obstacle,” said Karen Furtado, partner at Strategy Meets Action, as quoted in Insurance Networking News. “Carriers wonder, ‘Is my solution going to be viable in 10 years? How much will my software change and will it be worth it?’”

The trend toward consolidation likely will continue and accelerate, she adds. “Ownership changes will continue as private firms continue to get more involved in emerging technologies … Vendor consolidation is no different. Technology is changing quickly, so providers will turn to consolidation to add needed complementary capabilities.”

Because you get an end-to-end solution from a single partner, a SaaS-based suite can address those concerns, as well as those around infrastructure, services, and support. Your risk exposure is limited because you’re working with fewer vendors and your technology portfolio is pre-consolidated.

SaaS is the Ultimate in Scalability

“Scalability” typically is understood as the ability to grow and add resources, including servers, licenses, and users. But really, it’s more than that. It entails being able to do so quickly and economically, as well as temporarily. Because it spans infrastructure, services, support and security through a single partner, SaaS offers the ultimate in scalability.

Those considerations, as well as those around the benefits of operational vs. capital expenditure, are leading insurers to conclude that a Software as a Service model is more attractive than an on-premise implementation.

In a true SaaS environment, the requirement and expense of managing your own data center go away, enabling small- and medium- size carriers to benefit from the same cost structures and advanced technology–including analytics, computing, database, mobile, networking, security, storage and web–as their larger competitors. That’s what scalability means in the C-suite.

SaaS Operationalizes Digital Transformation

Due to pre-integrations and the ever-ready and continuously-updated state of SaaS platforms, insurers are able to more immediately use and benefit from more of the system’s functionality for digital communications, data-driven decision making, and predictive analytics, for example.

SaaS also relieves your IT personnel of repetitive and non-value-added responsibilities, like maintenance and upgrades, so they can concentrate on other business challenges, such as optimizing the customer experience and preparing to use new data sources, including those obtained from telematics and other third-party providers.

If you’ve been postponing your digital transformation, concerned about costs, the integration of emerging and rapidly changing technology, or the dearth of local talent, the wait has finally paid off. A mature insurance core systems platform now is available to jumpstart your digital transformation.

For more details on Duck Creek’s vision for the future of insurance, you also can download our Future Playbook.