Constrained by regulations and legacy systems, insurance carriers have historically been slow to adopt the latest technologies to drive product innovation– until now. In just the past few years, it has become evident that the transition to a digital insurance model is underway.

But why? Sure, there is a seemingly endless upside to optimizing internal processes and implementing solutions that make day-to-day tasks easier. The motivation goes deeper than that and is ultimately targeted at creating the optimum customer experience — a more humanized customer experience. With digital insurance solutions, insurers can meet and exceed the expectations of their customers at every touchpoint, from the initial policy shopping process through underwriting and in claims.

What is Digital Insurance?

The concept of “digital insurance” is an umbrella term encompassing the vast number of new technologies that have changed how nearly every insurer operates. One definition of digital insurance is the use of a technology-first engagement model to sell and manage insurance policies. Many insurance companies today have a digital insurance arm of their business in addition to traditional insurance practices.

See Also: Watch the webinar replay where author Geoffrey Moore shares his thoughts on how insurers might approach digital transformation

These providers generally differentiate themselves in a few key ways:

- A focus on engaging with the customer at their chosen point of digital contact

- Omnichannel experiences – you can research, compare, and purchase insurance online or through an app without having to speak directly to an agent in person or over the phone

- Pricing, risk evaluation, and/or claims handling rely on modern, open software platforms connected to the insurtech ecosystem (new insurance-specific technology)

- Coverage options are creatively structured to cater to businesses and consumers with diverse insurance needs

To compete in today’s evolving insurance industry, carriers must provide the speed, agility, accessibility, and ease of use that only digital insurance can deliver. This means offering a range of services on the customer-facing side of operations – and internally, for that matter – that are entirely online. This is a sharp deviation from the traditional insurance model.

But what does that look like? Features such as live chat, customer self-service portals, and online claims filing are all made possible by digital insurance applications and technologies. To start, however, insurance carriers have to implement some of the technological pillars of digital insurance, namely important digital tools and applications.

The Digital Insurance Value Chain

Most digital insurance innovation occurs across customer-facing functions and applications. In doing so, insurers are investing in their growth and in their most valuable asset — the customers. These components — the insurance operations that generate value — are what is known as the insurance value chain. These should be priority number one for any undertaking related to digital insurance.

The digital insurance value chain includes:

- Line of business products

- Sales and distribution

- New business underwriting

- Claims

- Payments

- Customer service

Every element of this value chain benefits the insurer, intermediaries, and policyholders with the adoption of digital insurance tools and applications.

Digital Insurance Tools & Applications

The digital revolution has brought about a paradigm shift in the way insurance companies operate, with a plethora of advanced tools and applications leading the change. These are designed not only to streamline operations but also to enhance customer experiences, offering personalized services like never before. Here are a few key digital tools and applications revolutionizing the insurance industry.

Artificial Intelligence

Digital insurance has evolved with speed and scalability in mind. AI gives insurance teams throughout the value chain the ability to quickly answer complex questions related to policy applications that would be difficult and time-consuming to make otherwise. AI in insurance will impact some of the primary functions of the industry, including:

-

- Underwriting

- Claims

- New Business

- Marketing

- Retention

What makes AI unique in the insurance space is the balance it strikes between enhancing operational insurance functions and personalized service. Today’s consumers want speed, but they also want to feel valued.

AI also allows insurers to provide context-driven service to customers in a way that doesn’t make them feel like just a number. Machine learning, a subset of AI, utilizes historical and macroeconomic data, customer data, and algorithms to predict risk and automate and speed up insurance tasks across the value chain.

Internet of Things

In the insurance industry, data is king; it helps drive underwriting, pricing, policies, and more. With the Internet of Things (IoT), carriers can collect troves of real customer data in real time and use it to better inform customer profiles and coverage – even discover potential instances of fraud.

So, what connected technologies are fueling the digital insurance data boom? Telematics, for one, are a set of technologies insurance companies are using to monitor the condition and use of assets like trucks, cars, or heavy equipment and improve the accuracy of their coverage.

Customers have to opt in, of course, but most people are willing to share this type of data to save money on monthly premiums. The widespread use of smart devices, in the home, car, or even in medicine, is another opportunity for carriers to leverage the capabilities of digital insurance.

Big Data & Analytics

Data is an insurer’s most valuable asset. All of these digital technologies generate Big Data – data that contains greater variety, arriving in increasing volume and with ever-higher velocity – essentially giant data sets that contain actionable information.

All of this data gives insurers greater insights into customer behavior and risk than ever before. To properly utilize this data, insurers need robust analytics systems that paint a complete picture of their business and customers by pulling data from disparate systems and consolidating it into actionable insights.

Insurers who can be agile with the data they have, to either improve their existing offerings or increase their speed to market with new products, will reap the biggest benefits from digital insurance.

SaaS Capabilities

Speaking of speed, digital insurance capabilities are just that, digital, so it doesn’t make much sense to host these solutions on-premises. To maximize the potential of all of the aforementioned technologies, most digital insurers use a SaaS-based solution that provides the hosting, support, and resources for all digital insurance tools and applications.

3 Benefits of a SaaS Insurance Solution

In the ever-evolving landscape of the insurance industry, SaaS delivers transformative solutions that empower businesses to stay ahead. Let’s delve into the manifold advantages of leveraging a SaaS-based solution in insurance operations.

-

Agility

The insurance industry is characterized by continual change and the need for rapid adaptation. SaaS solutions offer businesses remarkable agility, enabling them to work more efficiently and develop new products for emerging market opportunities in a fraction of the time traditionally required.

According to McKinsey, companies using SaaS can bring new products to market 20 to 40% faster than their competitors.

-

Scalability

With SaaS, insurance firms can flexibly scale their operations as market demands shift. As insurance products are introduced, altered, or withdrawn, SaaS platforms can scale up or down to meet these changes effectively.

Additionally, Gartner predicts that by 2022, as much as 75% of all databases will be deployed or migrated to a cloud platform, up from only 5% in 2015, highlighting the considerable scalability advantages of SaaS solutions.[H3] Always Updated Software

-

Security

Security is a paramount concern for insurers handling sensitive customer information. SaaS solutions provide robust security protocols to keep customer data safe and secure. Reputable SaaS providers would ensure that robust security measures are in place to keep customer information secure.

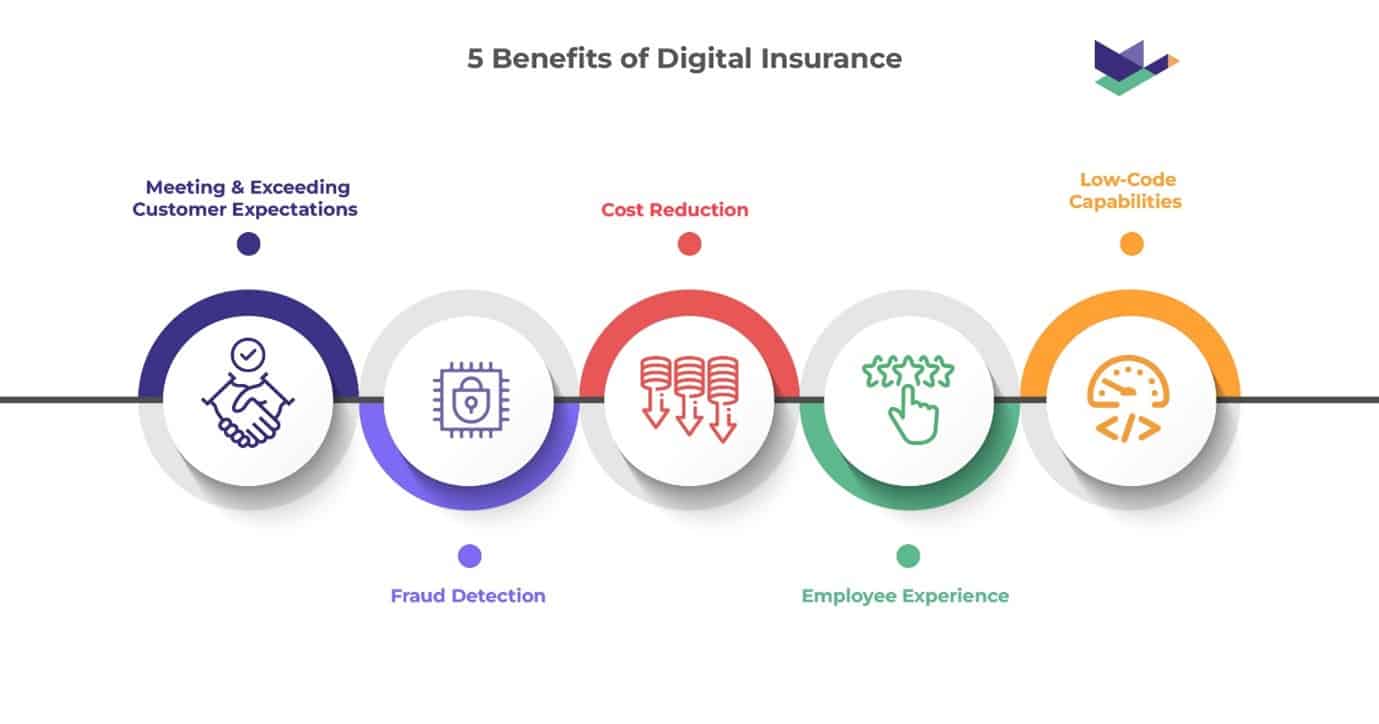

5 Benefits of Digital Insurance

Insurers know the intrinsic value of being on the cutting edge of the industry; insureds want to know and trust the insurance carrier they are working with. Implementing digital insurance solutions is the simplest way to build this trust, and insurers will quickly see the benefits, such as:

-

Meeting & Exceeding Customer Expectations

Whether it be communication, payment, or other services, insurers must have the infrastructure to meet the expectations of insureds.

Digital insurance makes that possible, with features like self-service portals, live chat, and insurance apps catering to modern consumers and making key insurance functions like policy administration, claims, and billing highly automated.

-

Fraud Detection

One of the benefits of digital insurance applications is the sheer volume of data that they generate. And while it is generally positive data that helps insurers perform their jobs better and customers to get better rates, data is also catching fraudulent activity. Customer relationship management software can be used to search customers’ social profiles for any activity related to a claim, and predictive analytics is being used to spot trends in customer behavior that might be a red flag for fraud.

-

Cost Reduction

Going digital has been shown to greatly increase cost savings, both for insurers and insureds. With more accurate underwriting driven by big data, AI, and predictive analytics, insurers and insureds both save big.

Digital insurance is also increasing the speed to market of new products, generating premium growth to offset costs. The McKinsey report, Digital Disruption in Insurance: Cutting Through the Noise, says “Digital technology puts margins under pressure as premiums fall under the weight of price competition and as new ways of mitigating risk emerge.Under these conditions, insurers will need to harness digital to make their operations more efficient, aggressively lowering costs.” The report says insurers can expect cost savings of as much as 40% from the claims process.

-

Employee Experience

Digital insurance is just as valuable to insurance brokers and employees as it is to policyholders. Digital tools such as comprehensive dashboards, SaaS applications and tools, and unified data systems not only make the jobs of line employees easier but also help them perform their job duties better.

-

Low-Code Capabilities

There is a common and valid concern that converting to a largely digital operation will require hiring developers, IT professionals, and people who are well-versed in working with these digital insurance tools.

Fortunately, low-code solutions exist to mitigate these fears. Low-code is an easy-to-use development methodology that lets users reuse software components to build their digital solutions — no need to hire an entirely new team of web and application developers.

Key Takeaways

The difference in revenue-generating capabilities of digital insurers compared to those that are not leveraging technology is stark. Digital insurance is accessible and possible for many who turn to a for their core systems.

SaaS-based digital insurance is a scalable cloud solution that is always available and continuously updated to ensure insurers operate with the latest systems and software. These capabilities allow insurers to quickly benefit from the functionality offered by digital insurance. Insurers can begin creating a personalized experience that ensures customers feel valued and remain loyal for years to come.