Editor’s note: this is the first in our Solving For Tomorrow series, in which we offer our thoughts on the state of the insurance industry, the challenges carriers face now, and the opportunities they must take advantage of to remain competitive in an ever-changing future. Stay tuned in the coming months, as this will be a regularly published series. We hope you enjoy and learn, and we’re always happy to receive your questions and feedback.

Spending our lives working on behalf of insurance has put us in the dual position of both outside observer and front lines change agent. We’ve lived the movements of this industry as a partner to carriers large and small in their quest to modernize core systems. As a result, we’ve developed a unique point of view on what it takes to win in this ultra-competitive world.

This work is the first in a series that aims to capture and share our collective wisdom as an organization for the benefit of those working in our industry. The current rate of change is a given. However, the question remains: How do leaders and organizations need to respond?

If we were to view the world through a pessimist’s lens, we would say that insurers are in big trouble. (“Fat, complacent, and happy” were the words of one tech investor we interviewed.) Newer, leaner, and nimbler competitors are circling, finding ways to carve out a piece of the $1 trillion+ U.S. P&C Insurance pie. But warnings and provocations without meaningful follow-up or guidance have not been helpful. Neither is treating every passing fad as the next game-changing force by which carriers will live and die.

We’re here to help carriers find the signal through the noise. We will cover the topics that we believe will have a real impact on the future of this industry and filter out shiny objects that are more bluster than bite. Most importantly, we’ll make sense of what all of this means for your business, your people, and your platforms – getting as specific as needed to help you forge a genuine path to the future.

What’s Happening In Our World

Major forces shaping our industry

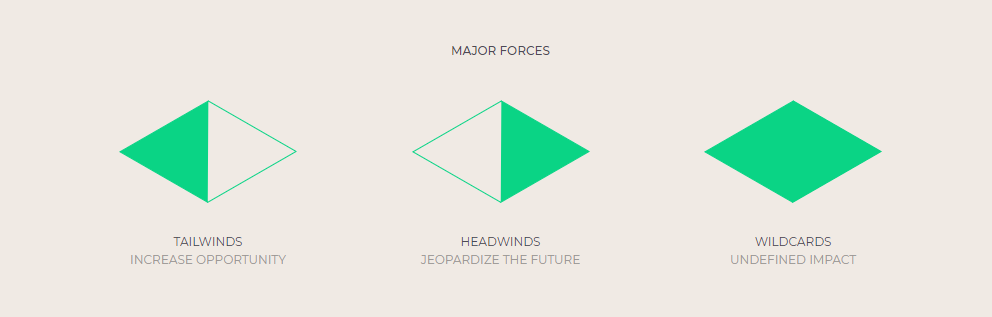

Over the course of countless conversations, layered on top of decades of industry experience, dozens of themes emerged for each of these categories. Our team assessed each topic by maturity of idea and magnitude of potential impact (e.g., the ideas that have matured beyond hypothetical concepts or isolated pilots). We used these lenses to narrow the world down to the formidable forces that carriers need to address in the near- and medium-term.

In short, we believe that the carrier who is able to successfully capture the opportunities in the Tailwinds, neutralize the dangers in the Headwinds, and solve for the inherent complexities in the Wildcards, is the carrier best able to build and sustain a true competitive advantage.

Tailwinds

Digital: Today’s buzzword, tomorrow’s opportunity

The word “digital” has evolved and morphed in meaning as quickly as the pace of technological change itself. As a result, the term has become an empty vessel at best and a meaningless buzzword at worst.

The word “digital” has evolved and morphed in meaning as quickly as the pace of technological change itself. As a result, the term has become an empty vessel at best and a meaningless buzzword at worst.

As it relates to insurance, the current focus is around emerging modes of interaction that give carriers access to a treasure trove of new information. If this data is used strategically and in the right combinations, it can lead to better products, new opportunities, and an altogether superior experience.

Two factors have been driving this recent conversation:

-

Mobile – as a tool for carriers to reach and service policyholders, but also as a way to collect behavioral data critical to improving risk understanding

-

Internet of Things – a continuous feed that monitors the health and performance of assets and environments under coverage

For Personal Lines:

Meeting customers where they are

Even though digital-only carriers like Lemonade have become the darlings of this industry*, and policyholders are demanding omnichannel experiences, the solution isn’t to digitize everything. Instead, carriers need to consider how digital can co-exist with (and complement) in-person interaction. Understanding this equation will allow carriers to deliver products, services, and information effectively and efficiently across the appropriate channels.

Deeper insights

As carriers’ relationships with policyholders deepen through digital interaction, so do the quality and quantity of information gathered. This is valuable fodder for carriers to hone their value proposition in the form of more tailored products (e.g., usage-based vs. fixed-price), a higher level of service, and a better way of working for employees and sales partners.

An evolving role and value

Continuous monitoring lets carriers notify policyholders of impending events, offer tips to prevent damage, and even pre-fill claims before the First Notice of Loss. This ability paves the way for a fundamental shift in the role and value of carriers—from the folks you call when something bad happens, to an active partner in keeping you and your possessions safe. (Note: this dynamic also holds true for the Commercial Lines side.)

*SOURCE: http://www.marketwatch.com/story/some-cool-insurance-products-are-finally-on-the-horizon-2016-10-27

For Commercial Lines:

More tailored offerings

Small businesses are a segment that lives between Personal and Commercial Lines in terms of needs and purchase behavior*. Here, carriers have the opportunity to provide a tailored (omnichannel) experience and offer value that caters more specifically to this historically underserved segment.

A more attractive partner

On the mid- to large-enterprise side, the ability for carriers to analyze and act on insights from a growing number of digital touchpoints allows them to build more profitable products, and offer more useful tools to the brokers who sell and manage these policies. This could be an important value-add to counter the Headwind of Changing Channels (covered in a later section).

*SOURCE: https://www.cognizant.com/whitepapers/property-casualty-commercial-lines-underwriting-the-new-playbook-codex2031.pdf

Diversity of assets: What’s mine is yours?

If you were to wake up a ghost of an insurance professional from the turn of the century and asked him to price the risk of a car driven by hundreds of different drivers over the course of a single month, or the exposure of a business whose funds consistently changed hands across multiple continents and platforms in a matter of milliseconds—he’d ask to go back to sleep.

If you were to wake up a ghost of an insurance professional from the turn of the century and asked him to price the risk of a car driven by hundreds of different drivers over the course of a single month, or the exposure of a business whose funds consistently changed hands across multiple continents and platforms in a matter of milliseconds—he’d ask to go back to sleep.

But the 20th century is when the vast majority of American insurance carriers were born*. For many of today’s incumbent carriers, the 21st century, with all of its innovation and disruption, is a scary place. On top of that, the emergence of the freelance economy, asset-sharing companies (e.g., Zipcar and Airbnb), and the impending proliferation of driverless cars, are reshaping risk pools many times over.

*TOP 25 CARRIERS: http://www.naic.org/documents/web_market_share_160301_2015_property_lob.pdf; researched individual companies by year founded from individual company pages

For Personal Lines:

A vacuum in coverage

Most policies that cover short-term or shared ownership relationships provide either incomplete or inflexible terms. Carriers are unclear about the level of service these policies require, or the correct way to gather the information needed during the claims process. At an even more fundamental level, carriers do not know how to capture the risk to be priced into rating models.

Systems not designed for paradigm shifts

For most insurers, even the addition of a new field of information represents months

of backend build-out. A large-scale change that takes into account multiple owners, durations, and data formats is close to impossible for many back-end platforms on which carriers are operating.

For Commercial Lines:

Changing nature of assets

The prevalent practice of companies leasing unused inventory has long created complications for underwriters. Today, even companies’ most important asset—their workforce—is no longer fixed, as freelancers and part-timers become more and more the norm. This has created pockets of opportunity for carriers to offer products and services catering to these short-term relationships. In the meantime, in the absence of appropriate coverage, employers/individuals bear the risk.

Changing nature of risk

Technology has changed the nature of risk pools. New payment methods have decreased transaction times and increased standards for security. Pre-collision sensors and driverless cars have the potential to minimize or even prevent man-made accidents altogether. At the same time, the implications of a loss event (like theft) are often misunderstood, and the magnitude of loss has grown exponentially. For example, cyber attacks, data breaches, and machine mis-learnings have emerged as new threats that can jeopardize companies’ very existences. These risks (and others like them) are not yet covered by traditional underwriting, opening up the market to first movers who can offer appropriate coverage.

In our next installment, we will delve into Headwinds - forces that may jeapordize the future. If you can't wait to read more, download The Future Playbook today.