Editor’s note: This blog has been updated in Jan 2024 for comprehensiveness.

Artificial intelligence (AI) has changed the insurance industry – and it’s had a significant impact on customer service. One of the most common forms of AI are the use of chatbots. Typically, instead of interacting with a human, you’re “chatting” with a bot that’s programmed to understand your questions and direct you to the right place.

Chatbots are an innovative tool that can offer many benefits for insurers, such as around-the-clock support for consumers. These automated insurance agents can provide information almost instantaneously and guide consumers to appropriate resources for more information.

- The Intersection of AI and Chatbots in Modern Insurance

- GenAI and the Risk of Hallucinations in Insurance Chatbots

- 8 Insurance Chatbot Benefits

- Challenges That Insurance Chatbots Can Solve

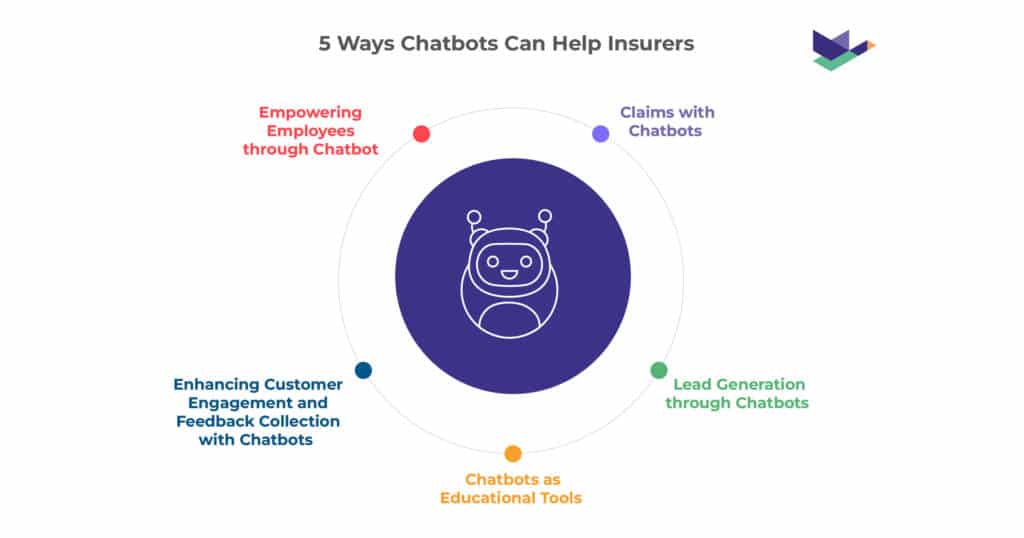

- 5 Ways Chatbots Can Help Insurers

- Embracing the Future: The Role of Chatbots in Modern Insurance

The Intersection of AI and Chatbots in Modern Insurance

Today, chatbots are more than just a set of pre-programmed questions and answers. They are an embodiment of AI, leveraging the power of Natural Language Understanding (NLU) and Natural Language Processing (NLP) to function as dynamic and responsive virtual assistants. Their ability to parse, understand, and respond to human language inputs with contextual relevance is a key factor in their effectiveness.

GenAI and the Risk of Hallucinations in Insurance Chatbots

When discussing AI and chatbots, it’s integral to also mention Generative AI (GenAI) – a rising topic in the world of insurtech. However, carriers need to exercise caution with GenAI responses due to the risk of “AI hallucinations”, which may occur when an AI model incorrectly generates and presents false or illogical data as facts.

As Jess Keeney aptly puts in a recent article, “The insurance industry will not tolerate hallucinations or the distribution of inaccurate data. Inaccurate or biased data can result in inaccurate risk assessments or pricing models, inappropriate customer recommendations, and incorrect coverage summarizations. The risk of exposing covered policy holders to incorrect information is tremendous.”

With the right caution, fact checking and adequate training provided for an AI model, the usage of AI in chatbots can be beneficial to insurers and their customers.

8 Insurance Chatbot Benefits

How common are chatbots? According to Moz, 80% of brands are using chatbots for customer interactions today. Statista also reported that the chatbot market is expected to grow significantly, reaching approximately 1.25 billion U.S. dollars by 2025. This represents a substantial increase compared to its size in 2016, which was 190.8 million U.S. dollars. Here is a list of their most popular benefits:

-

Efficiency and Convenience

These virtual agents provide an easy way for consumers to gather information or ask questions on their own schedule. They don’t have to wait a day or two (or longer) for an email response – or stay on hold waiting for the next available customer service representative.

Chatbots not only provide a quick and efficient way for consumers to gather information, but they are also a form of AI. This means that beyond just providing set responses, they utilize natural language understanding and processing to interact with users, creating a dynamic and more human-like interaction.

According to Chatbots Magazine, businesses could save over $8 billion per year by 2022, up from $20 million in 2017, thanks to chatbots.

-

24/7 Availability

Chatbots are available around the clock, which means customers can submit a question when most other help lines and agents aren’t available, such as nights, weekends, and holidays. According to Finance Online, 64% of users say the best insurance chatbot feature is the ability to contact customer service 24 hours a day.

-

Immediate Answers

In many cases, when customers have questions, they are looking for answers almost instantly. HubSpot calculated that of the 71% of customers who use messaging apps for customer service, many do so because they want answers quickly – and chatbots may be the answer because of their easy-to-use functionality and availability.

-

Reallocate Employee Workload

Insurance chatbots can also free up employees who may otherwise be answering phone calls or replying to emails, which can save time and money. In fact, Juniper Research estimated that chatbots will help businesses save over 2.5 billion hours by 2022.

Chatbots can help employees process and manage new claims and handle ordinary tasks such as updating accounts. They can even provide personalized quotes.

-

Streamline Processes

Chatbots can impact and streamline everything from claims to data insights. They can automate these tasks, increasing efficiency across the board.

By 2022, conversational platforms are expected to be engaged by 70% of white-collar employees on a daily basis, as stated in a report by Gartner.

-

Improve Customer Relationships

Chatbots can influence customer perception positively. According to HubSpot, the majority of millennials who have interacted with a business’ chatbot say the experience positively impacted their perception of the organization.

-

Lead Generation

When customers interact with a chatbot, they may be expected to fill in basic contact information, such as name and email address. This is a simple, easy way for insurers to generate leads.

-

Integration with Social Media Channels

Chatbots can be positioned across channels that consumers use every day. “They accomplish their task, start to finish/, in the place where you already spend your time: messaging apps,” according to HubSpot.

Challenges That Insurance Chatbots Can Solve

Despite the numerous advantages that insurance chatbots offer, they are not without challenges. The implementation and operation of chatbots in the insurance sector can present hurdles that need to be properly addressed to fully leverage their potential.

Here, we delve into some of the key challenges that insurance chatbots can help solve, providing valuable insights for insurance companies keen on optimizing their use of this digital tool.

Understanding Insurance with Chatbots

For many consumers, property and casualty insurance is complex and hard to understand. Buying different types, renewals, and claims can be complicated – but insurance chatbots can provide clarity on the processes and help customers understand the associated costs.

Human Support in Chatbots Infrastructure

Even so, it’s crucial for insurers to always include a way for customers to connect with real employees. While chatbots can handle routine tasks efficiently, consumers still want assurance that they can talk to a real person when necessary.

Ultimately, the consumer needs to feel like the chatbot understands their question and can answer effectively, or they lose trust in the capabilities of the bot, or worse, in the insurer altogether. After all, the success of chatbots in insurance or any other industry heavily depends on earning and maintaining user trust.

Increasing Customer Service Capacity with Chatbots

Chatbots can also help insurers keep up with demanding customer service needs. The response time of chatbots is often faster than that of a human, and unlike people, chatbots can handle multiple customer queries simultaneously.

Innovative Customer Communication with Chatbots

Chatbots have answered a need for an alternative form of customer service communication. While some individuals still traditional channels like calling or emailing, others find chatbots less time-consuming and at times more efficient. In general though, “chatbots are best used in situations where a back-and-forth interaction is required,” according to Forbes.

5 Ways Chatbots Can Help Insurers

There are a variety of ways in which insurers can implement chatbots to create an effective customer service experience:

-

Process Claims With Chatbots

The utilization of chatbots in the claims process can revolutionize how insurers operate. Chatbots can field inquiries related to claims, provide updates on claim status, and even guide customers on suitable payment methods, delivering a seamless experience.

-

Lead Generation Through Chatbots

When customers interact with a chatbot, they may be expected to fill in basic contact information, such as name and email address, which is a simple and effective way to accumulate customer data and generate leads. This information can be passed along to sales teams.

-

Chatbots as Educational Tools

In many cases, someone will contact an insurer with questions about a product or process. A chatbot can answer questions and provide more information – or direct those inquiries to the appropriate departments or resources.

-

Enhancing Customer Engagement and Feedback Collection With Chatbots

Faster, more efficient, and often more engaging than traditional phone calls and emails, chatbots offer a proactive way for insurers to interact with their customer base. Moreover, they enable the efficient collection of feedback and data on various customer service inquiries, providing insurers with actionable insights into their customers’ experiences.

-

Empowering Employees Through Chatbot Assistance

As chatbots handle the heavy lifting of customer service inquiries, employees can focus their efforts on more critical tasks. This shift in workload can result in increased efficiency and improved job satisfaction. Plus, by relegating routine tasks to chatbots, insurers can focus employees’ efforts to address more complex and strategically important responsibilities.

Embracing the Future: The Role of Chatbots in Modern Insurance

To succeed in the modern insurance marketplace, carriers must focus first and foremost on the evolving expectations of their customers–expectations often driven by everyday influences completely removed from the world of insurance. Chatbots, together with AI and machine learning, are just one more innovative tool insurers can use to meet customer expectations and deliver the service their customers have come to expect.