A Winning Combination that Personalizes the Claims Experience

With increasing competition in the Property and Casualty (P&C) insurance market, the pressure to deliver on claims experiences that alleviate customer anxiety and speed up the claims process is high. Digitizing the claims process, the engagement between insurer and insured, and the processing of related data are important steps that together help insurers personalize the claims experience for both customers and claims staff, thereby influencing customer retention. A digital adoption platform (DAP) is one such digital technology that brings the benefits of personalization to claims customers and staff.

DAP Integration as Part of Your Claims Personalization Strategy

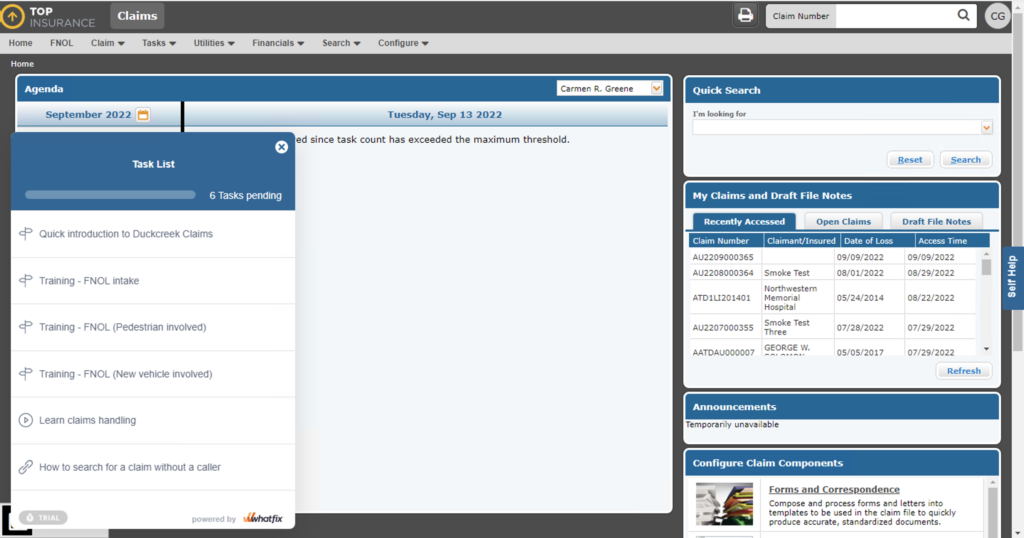

A DAP, when integrated with a modern core insurance system offers contextual in-app guidance such as walkthroughs, task lists, smart tips, self-help menus, and more to guide the user through every aspect of an application, throughout the workflow. This contextual, personalized guidance delivers on the afore-mentioned goals of speeding up claims processing and alleviating customer anxiety.

Identify and Address the Challenges to Claims Personalization

The table below highlights the challenges to claims personalization and the solutions to these challenges offered by integrating a modern cloud-based claims application with a DAP.

| Challenges to Claims Personalization | Personalization Benefits of Cloud-based Claims and DAP Integration |

| Legacy systems make it difficult to meet evolving customer and employee expectations of engagement and claims service. |

|

| Manual claims processing prone to human errors, processing delays, non-compliance with regulations, and miscommunication between insurer and customer. |

|

| Frequent product updates and employee turnover require hard to schedule claims support training, weakening ability of claims agents to respond to claimants’ questions quickly and accurately. |

|

| Lack of guidance in the field leads to claim assessment errors, incomplete documentation, delayed processing, and adjuster frustration. |

|

| Time-consuming and expensive to train insurance staff at scale when the insurer transitions from legacy systems to additional modern core applications besides claims such as policy management, billing, distribution, reinsurance, and customer portals. |

|

Duck Creek/Whatfix Claims Personalization Is Available Now

Duck Creek Claims integrated with Whatfix Smart Claims guides the user within the Duck Creek Claims environment by utilizing a contextual understanding of user attributes and claims characteristics, as well as the adjuster’s actions on a claim. Adjusters get access to claims-specific solutions, including ready-to-use templates, state-specific help tips, and smart nudges. This integration offers just-in-time help to adjusters as they process each claim, increasing efficiency, building confidence, and improving productivity – ultimately contributing to customer retention.

The low-code authoring environment and ability to merge existing knowledge repositories delivers a highly scalable learning environment for claims management staff.

Figure: Onboarding Task List in Duck Creek Claims Application Using Whatfix Integration

Zach May

Zach May

Zach May is a Partner Manager at Duck Creek Technologies, where he develops new and existing partner relationships and supports partners for Duck Creek to be successful utilizing the Solution Partner ecosystem through the sales process, integration development, and go-to-market activities. Zach holds a B.S. in Risk Management and Insurance from the University of South Carolina and has been with Duck Creek for over seven years. Zach lives in Salt Lake City with his wife Stephanie and their dog Barclay.

Sourabh Chirimar

Sourabh Chirimar

Sourabh Chirimar is the Senior Director and lead for ISV partnerships at Whatfix. He has over 15 years’ experience establishing and growing global strategic partnerships for startups and large technology companies. He holds an MS from Stanford Graduate School of Business. For further information, please email sourabh.chirimar@whatfix.com