The insurance industry has been in a state of flux: with new technologies, data-driven processes, and growing customer demands being major drivers behind this time of change. And while many changes are good — like the digital transformation of insurance and what that has meant for companies and customers alike — some of these changes have resulted in the industry facing its share of new challenges.

Here is a look at some of the biggest challenges facing the insurance industry, along with ideas and innovations to solve them.

Top Challenges Facing the Insurance Industry

1. Digitizing Small Commercial

A niche but highly profitable market within the insurance industry is small business insurance, otherwise known as small commercial insurance. While this section of the market had been relatively insulated from outside pressure to modernize and get on board with digital insurance technologies, that is no longer the case. Larger, more aggressive insurers understand the value of small commercial, and are making a push to both move into this market and update it. This is forcing carriers who already offer small commercial to significantly invest in new digital technologies to keep up with their competitors.

A report from PwC recommended three steps these insurers could take to stay relevant in the small commercial market:

- Improve customer experience with digital interactions

- Digitize underwriting and claims

- Invest in employees/talent

2. Commoditization

Insurers are constantly trying to one-up their competitors to win over new customers and retain their current ones. And while low rates are an excellent way to do that, another equally important factor for the modern consumer is how they are treated by the companies they work with.

Commoditization, the process of treating someone like they are a mere commodity, is a fast way to lose customers. They want to feel valued, important, and not like just another number. To achieve this, insurers have been deploying solutions such as artificial intelligence (AI) and automated processes to deliver personalized, yet fast customer experiences. Digital insurance technologies also help insurers create unique products quickly with low-code tools, as well as use complex data sets to improve risk pricing and offer better, more personalized rates.

3. Legacy Technology

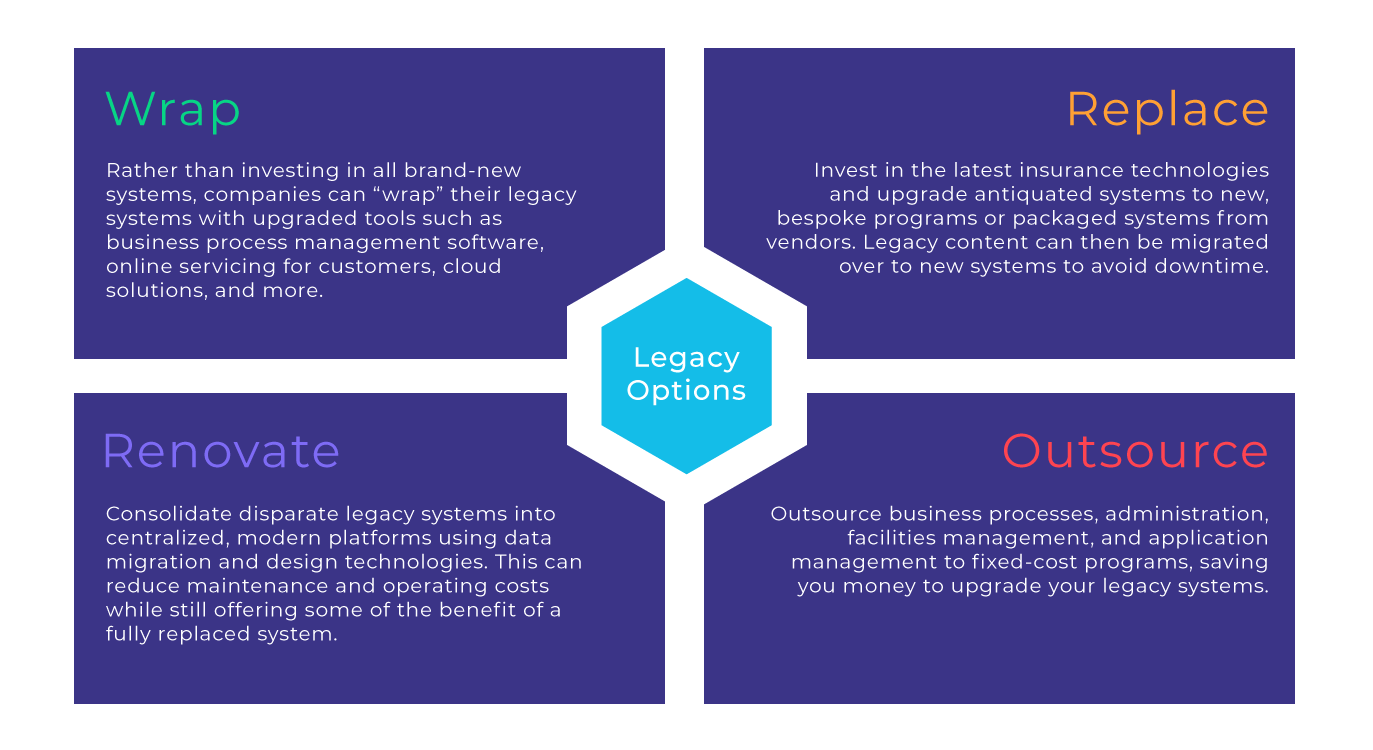

Did you know that it is not uncommon for insurers to spend up to 80% of their IT budget on maintaining legacy systems? As we’ve mentioned, digital technologies are driving major changes in the insurance industry at a pace no insurer can match with dated, legacy systems.

But there are solutions.

4. Improving Quality of Analytical Data

Data is constantly being generated and leveraged in the insurance industry. But as we know, quantity doesn’t always equate to quality. To get the most out of user, operational, and marketing data, insurers need to have robust data management plans in place. With these plans, they can improve the overall quality of analytical data and gain more meaningful insights to improve customer experiences.

Insurance industry experts at PwC make three operational recommendations to maximize data analytics practices:

- Clearly define a) the customer segments and interactions that are top priorities, and b) the insights needed to drive the experiences that result in new business and better customer retention.

- Take a holistic approach to data-driven decision making and push it out to the edges of the organization so everyone can make better, faster decisions. To facilitate this process, insurers can develop pilot programs that allow them to test what works and what doesn’t. In this environment, insurers can gain practical and practicable insight, as well as help develop a culture that understands the power of data.

- Modernize the data analytics foundation to make it agile, flexible, and reusable. To do this, determine the type of architecture that will work in the near- and long-term future, as well as a data governance strategy that promotes data quality and usefulness.

5. Using Data to Improve Experiences

While using data to improve offerings and, ultimately, customer experience is not a new phenomenon in the insurance industry, doing it well and consistently is still a challenge for many. There are outside factors at play here as well, as insurers grapple with market instability thanks to COVID-19, new legal hoops to jump through, and increasing competition across the market.

To meet this challenge and maximize data in pursuit of better customer experiences, companies must leverage the digital insurance solutions at their disposal. With agile cloud systems, data analytics capabilities, and more, insurers can meet the demands of today’s consumers with important features such as:

- Chatbots

- Mobile applications

- Omnichannel claims capabilities

- AI-generated quotes

6. Cybersecurity

Because so much of the world has gone digital, there is now an ever-present concern about cybersecurity threats. This presents a unique opportunity for insurers, as individuals and businesses alike seek out protection for their own data and privacy.

For individuals and businesses wary of identity theft or a data breach, insurers can cover the costs associated with cybersecurity issues, which can include contacting authorities, notifying individuals, settlement costs, fines, costs of discovering the cause, loss of business, loss of customers, loss of reputation, and cyber extortion. Providing this coverage can be a cost-effective, low-risk investment that shows insurers are forward-thinking and looking out for the best interests of their customers.

Insurance Challenges in 2021 & Beyond

Many of the challenges facing insurers today seem to relate to digital technologies. However, they also provide the right solutions. Digital insurance solutions and platforms are helping insurers of all types and sizes modernize their back-end operations and their offerings, which ultimately helps them increase customer satisfaction and revenue. If you would like to learn more about digital insurance technologies, please contact us.