Editor’s note: this is the third in our Solving For Tomorrow series, in which we offer our thoughts on the state of the insurance industry, the challenges carriers face now, and the opportunities they must take advantage of to remain competitive in an ever-changing future. Stay tuned in the coming months, as this will be a regularly published series. We hope you enjoy and learn, and we’re always happy to receive your questions and feedback. In case you missed it, you can read our last installment here.

In our last installment, we discussed major forces shaping our industry, delving into Headwinds, or forces that may jeapordize opportunity. In this installment, we will cover Wildcards – forces with as-yet undefined impact.

Wildcards

Regulation: the excitement (and anxiety) of more changes

Regulation: the excitement (and anxiety) of more changes

The entire industry is waiting to see what a newly-elected, business-friendly president and congress will do to industry regulation. Since (Federal) deregulation seems to be the prevailing direction (at least within the US; the opposite seems to be true in Europe), carriers find themselves either poised to take advantage of new opportunities or fearful that they’ll get left behind.

Data privacy

The first manifestation of this new regulatory shift has been the rollback of consumer privacy protections. This essentially gives internet service providers the ability to sell browsing data to private companies*. This move could give insurance companies access to a rich new data source for their projections of individual risk. However, carriers also need to weigh the ethical and brand risk associated with this level of intrusion, even if such a practice is technically legal.

*SOURCE: https://www.fastcompany.com/3066946/whats-the-fate-of-data-privacy-in-the-trump-era

National Flood Insurance Program

This FEMA-run program, designed to provide government assistance in flood protection, is up for renewal in September. Currently, it is $23 billion in debt and the Trump administration has proposed cutting $190 million from the program, or even shutting it down altogether*. This move would open the flood insurance market to privatization, giving carriers the opportunity to build new products and services. However, flood protection is a notoriously unprofitable line of business, so carriers need to be extremely cautious (and accurate in their pricing model) to avoid dealing with the fallout of adverse selection.

*SOURCE: http://www.propertycasualty360.com/2017/01/11/trump-presidency-could-bring-momentum-to-much-need

Federal vs. State oversight

Another regulation in question is the Federal Insurance Office (FIO), which could disappear if the Dodd-Frank Act is rolled back. The FIO has oversight into risk-related matters of insurance companies, including the kind of asset classes into which carriers can invest, and the types of risk they can cover. Removing these barriers could have a huge impact on insurers’ investment strategies and open up alternative sources of revenue*. Meanwhile, states continue to move toward tighter regulation, particularly around pricing practices. For the moment, state regulators appear to be in the driver seat for determining the immediate future of regulation.

*SOURCE: http://www.carriermanagement.com/news/2017/01/30/163685.htm

AI / Big Data: So close, yet still so far away

AI / Big Data: So close, yet still so far away

We’ve all sat through many tech presentations that start with the words “Imagine a world where…” But for carriers, it’s never been about a lack of imagination. In no other industry has there been as wide of a chasm between collective ambition and back-end feasibility.

Carriers are watching with fascination (and dread) as boundaries blur between the imagined and the possible. As sensors feeding the Internet of Things are able to capture and predict reality at a fidelity never seen before, and machine learning is able to make sense of boundless quantities and formats of data, the future of this industry is being played out between hypothetical theory and technological feasibility.

The downside risk of being first

This is an ironic position for today’s carriers to be in, as insurance companies tended to be relatively early adopters of IT/software. In the 1960’s, insurers and banks were on the cutting edge of IT—they were among the first to hire computer scientists and programmers to build their own solutions*. Unfortunately, by moving early and investing heavily in technology that used programming languages that quickly became outdated (who knew things would move as quickly as they did?), carriers have had to build out functionality in-house, leading to islands of automation/flexibility and function-rich silos separated from the rest of the organization. This fragmented system has inhibited carriers’ ability to capture, share and utilize data needed to drive prioritization, design, and innovation for their products and services.

*SOURCE: http://www.asiwi.com/2016/01/the-wondrous-evolution-of-insurance-technology/

Finding the needle in the haystack

Within this highly fragmented and patched-up world, building a full-fledged data/insights team is a huge task. It requires everything from hiring the right talent, to setting up parameters around data collection and sanitation, to making sure that information is shared across organizational silos. There is also the issue of finding meaning in the different sources of collected data. Adoption of new technology has been slow and case studies are few, meaning that there is no industry rubric or set of best practices to lean on as carriers seek to connect findings to profitability, efficiency, or retention.

The awkward “now what?” moment

But let’s assume carriers are able to successfully stand up world-class analytics teams that can generate game-changing insights and promise to set new standards in product profitability and service delivery. Then the battle shifts to how to build these insights into actual rules and products. Here, once again, we run into the problem of legacy systems that force product code into silos, leading to products built from a code “stew,” devoid of thoughtful hierarchy, consistency, and definition. This, in turn, forces carriers to rewrite every line of code associated with a product for even minor updates. It also makes the ability to test new products with a limited audience and without disrupting existing operations a distant pipe dream.

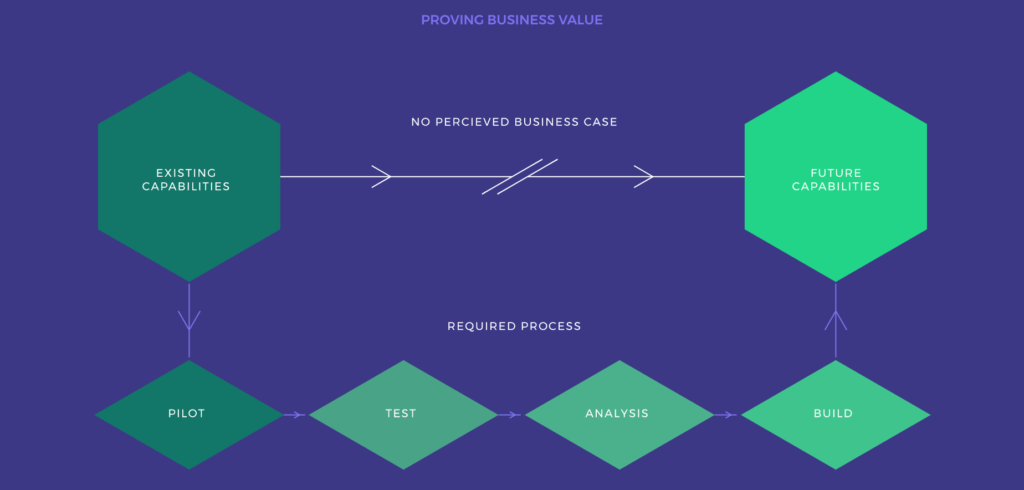

Chicken or the egg

This inertia is driven by the fact that new technologies cost a great deal and have yet to be proven in terms of business value—because there is no easy way to build this case. Existing systems do not accommodate easy and quick builds—thus preventing testing and experimentation. By default, this makes all cases for product profitability and service efficiency strictly theoretical. When theoretical returns are presented to those who work in the business of putting tangible numbers to potential risk, it does not hold water.

SaaS: The promise of flexibility made real?

SaaS: The promise of flexibility made real?

When it was first introduced, Cloud seemed to be the answer to the most pressing hurdles to adoption of new technology. It promised to reduce cost of ownership, level the corporate playing field, make updates seamless, and grow with your business. For many industries, these promises have come true, and have changed the way companies are able to operate and grow. Within insurance, however, there remains a “wait and see” mentality. Questions will continue to surface around the benefits that Cloud holds for how policies are written, sold, and serviced. We believe that as carriers see more proof of concept, objections will wane—along with the barriers that have historically held back the industry.

Calling it what it is

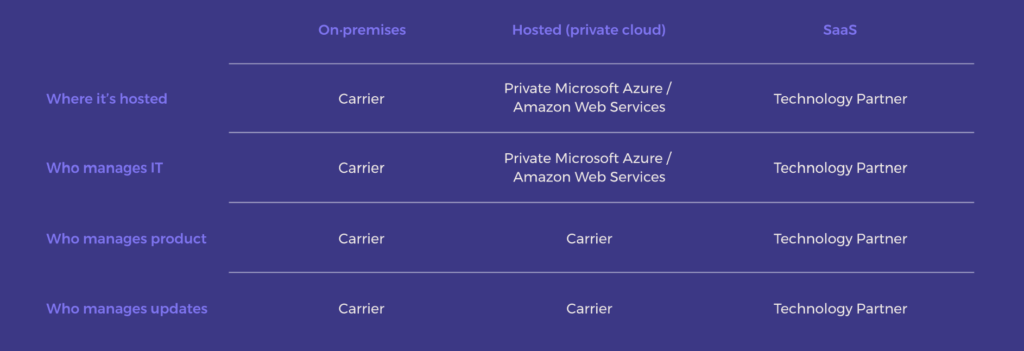

Looking at the landscape of insurance technology vendors, many are promising a SaaS option that’s essentially a privately-hosted product that is altogether different from their on-premises solution. For example, a vendor may have a feature-rich option that has to be installed on-premises and another option that can be accessed via the Cloud. But, their Cloud option can only handle about 30% of what the on-premises option can handle. In fact, looking more closely, it’s a different product altogether with a completely different code base.

In this scenario, carriers would have to decide how much functionality they’re willing to sacrifice for flexibility. If they want a Cloud-accessible version of the on-premises product, they’d have to host it themselves. Any subsequent updates will be costly as it still would have to be individually installed.

Marketing dollars and PR spin can stir up a lot of confusion, so it’s imperative that carriers know the difference between on premises, hosted, and SaaS, and the pros/cons of each delivery model.

In the Hosted (private Cloud) scenario, carriers have to communicate between their Cloud vendor (e.g., Microsoft Azure and AWS) and the technology partner whenever there is a glitch or an update, adding a layer of complexity. True SaaS works from a common code base, so updates (and glitches) are managed entirely by the Technology Partner.

In short, if you want to know if a product is true SaaS, ask your potential tech vendor how updates work – and what the total cost of ownership is to stay current.

A note on data security

It’s impossible to talk about SaaS without talking about security risks. The perception is that by moving critical processes (quote, bind, first notice) onto the Cloud, it somehow feels like the front door of your business has been opened to the entire internet. But as SaaS has started to become the standard in some industries, security technology has grown in sophistication and rigor. The day is quickly dawning that data is more secure (and more cost-effective to manage) on partner-maintained multi-tenant Clouds (with higher security compliance standards) than on private Clouds/data warehouses.

What to remember

The biggest upside of SaaS is that you’ll always be up to date with the latest features and functions. This removes the burden of maintenance and upgrade from carriers’ IT organizations, avoiding the scenario of upgrades becoming unaffordable (up to 75% of purchase price*), and leading to orphaned releases and outdated systems.

SaaS allows carriers to focus on differentiating themselves in more important ways through marketing, brand, customer experience, and risk models—not their IT systems. Advantage is created from business strategy configured into products and services, rather than developers customizing code.

*SOURCE: Internal Duck Creek documentation on competitive intelligence from customer/prospect interviews

In our next installment, we will delve into implications for how carriers need to respond to these forces. If you can't wait to read more, download The Future Playbook today.