The necessity for efficient insurance billing in the industry is undeniable. With the rise of customer expectations and complex regulatory landscapes, insurers are now facing the challenge of delivering a billing experience that not only satisfies customers but also drives business outcomes. One such solution is Duck Creek Billing, a cutting-edge software that addresses these complexities while propelling insurance companies towards greater operational efficiency.

- 3 Common Challenges Faced by Insurers in Handling Billing Procedures

- Why Choose Duck Creek Billing?

- Exploring Key Features of Duck Creek Billing

- The Impact of Duck Creek Billing on the Insurance Industry

- Unleash the Power of Innovation: Adopt Duck Creek Billing Today

3 Common Challenges Faced by Insurers in Handling Billing Procedures

The insurance industry faces various trials in managing billing procedures. This section explores these challenges and how they impact insurers.

-

Manual Processes and Complex Calculations

Handling manual billing processes is laborious and prone to error. Inaccuracies can lead to customer dissatisfaction and escalations, leading to lower retention rates. In fact, a report by Bain & Company found that reducing customer churn by just 5% through satisfactory service can increase profits by 25% to 95%. Furthermore, complex calculations for commissions, premiums, and discounts compound this challenge. Read how Duck Creek’s premium payment processing system can help your insurance agency streamline payments.

-

Regulatory Compliance

Insurance companies operate in a heavily regulated environment. Ensuring regulatory compliance is vital but complex, as it involves adherence to jurisdictional rules and handling the changes in these regulations.

-

Keeping Up with Technology

The rise of digital payments has compelled insurers to stay updated with the latest technology trends. Failing to meet customer expectations in providing flexible, modern payment options could result in losing customers to competitors.

Why Choose Duck Creek Billing?

Duck Creek Billing is a powerful tool that addresses the challenges of modern insurance billing with ease and efficiency. It offers insurers a streamlined, innovative solution that not only meets the evolving expectations of customers but also drives significant business growth. Now, let’s delve deeper into some of the standout features of Duck Creek Billing that make it a top choice for insurers.

-

Diverse Payment Methods

Duck Creek Billing, a product of Duck Creek Technologies, is designed with a unique blend of features that put it a cut above other billing solutions in the market. Notably, it provides a suite of diverse payment methods, thereby catering to modern customer’s expectations and attracting a broader client base. This expansion of payment options opens the doors to enhanced market share and increased revenue streams for insurance companies.

-

Tailored Commission Plans

Additionally, the software offers tailored commission plans, a feature that serves as a strong competitive advantage. By attracting and retaining top brokers and agents, insurance companies can encourage more policy placements, thereby accelerating business growth.

-

Low-Code Tools for Rapid Configuration

With Gartner predicting that low code will be responsible for more than 65% of application development activity by 2024, Duck Creek Billing’s low-code tools came in at the right time for rapid configuration of billing plans.

This innovation leads to reduced time-to-market for new plans, thus allowing insurance firms to respond swiftly to market changes. Such nimbleness enhances customer satisfaction and maintains a competitive edge in the marketplace.

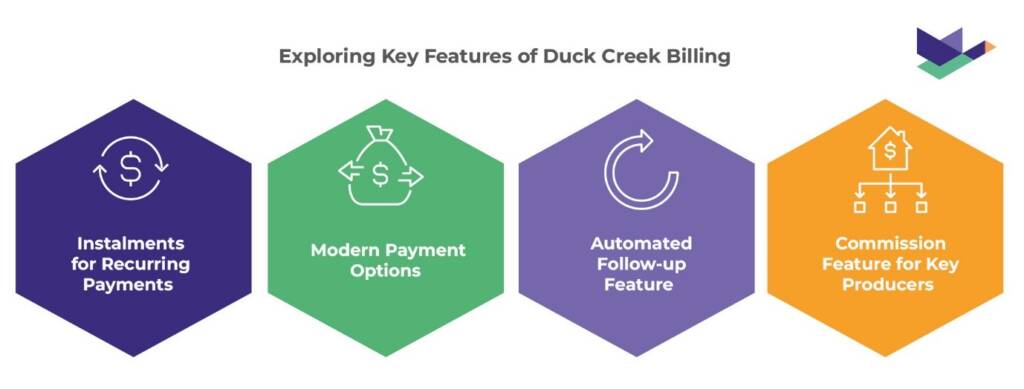

Exploring Key Features of Duck Creek Billing

Duck Creek Billing boasts a wide array of features designed to revolutionize the insurance billing process. Let’s take a closer look at its standout functionalities and how they can streamline operations, enhance customer satisfaction, and drive business growth.

-

Installments for Recurring Payments

The installment feature of Duck Creek Billing supports recurring payments, a crucial aspect of customer retention. By providing a consistent and reliable payment schedule, insurance companies can foster trust and loyalty with their clients.

-

Modern Payment Options

A Weave survey showed that offering multiple payment options can lead to a conversion increase of up to 30%. Duck Creek Billing is not just about traditional methods; it also embraces digital transformation by offering a range of modern electronic payment options. Additionally, Duck Creek Billing is set to provide a Payments Marketplace integration with Imburse in 2024, further enhancing its payment flexibility.

-

Automated Follow-Up Feature

Efficient cancellation processing and reinstatement are made possible by Duck Creek Billing’s automated follow-up rules. This feature not only streamlines operations but also ensures that customers are consistently informed, fostering trust and loyalty.

-

Commission Feature for Key Producers

A McKinsey study found that the right incentives could increase sales productivity by 50%. Duck Creek Billing’s commission features offer automated commission calculations and custom plans for key producers, allowing insurers to cater to their top producers’ specific needs effortlessly, bolstering their relationship and fostering a sense of loyalty.

The Impact of Duck Creek Billing on the Insurance Industry

Duck Creek Billing brings together the innovative functionality and core toolset needed to deliver a more modern experience across the insurance industry. The software’s advanced capabilities have been widely adopted by numerous insurers, demonstrating its effectiveness in handling complex billing procedures. It caters to the evolving needs of the insurance market, making it an invaluable tool for all insurers.

Unleash the Power of Innovation: Adopt Duck Creek Billing Today

Duck Creek Billing offers a competitive edge to insurers by simplifying complex billing procedures and enhancing operational efficiency. Its rich array of unique features serves to improve both customer and agent satisfaction, making it an optimal choice for any insurer looking to improve their billing system. So why wait? Embrace the revolution today with Duck Creek Billing.