Reinsurance plays an instrumental role in maintaining the financial stability of insurance companies and managing risk. It involves passing on portions of the insurer’s risk portfolios to other parties to reduce the likelihood of having to pay a significant obligation resulting from an insurance claim.

- The Crucial Role of Reinsurance in the Insurance Industry

- Top Reasons to Modernize and Automate Reinsurance

- 5 Issues with Legacy Reinsurance Systems

- 3 Advantages of Technology Integration into Your Reinsurance Software/Process

- 5 Key Benefits of Using Duck Creek Reinsurance

- 4 Standout Features of Duck Creek Reinsurance

- Real-life Application: Case Studies

- Duck Creek: The Complete Reinsurance Management Solution

The Crucial Role of Reinsurance in the Insurance Industry

According to Swiss Re, one of the world’s leading reinsurance providers, reinsurance plays an essential role in the global market economy by making insurance markets more resilient and ensuring the insurance industry can cover losses, especially in disaster-prone areas.

To further highlight the importance of reinsurance to insurers, Munich Re, the largest reinsurance company worldwide in 2020 and 2021, suffered high reinsurance losses due to aforementioned catastrophic events, specifically from earthquakes and flooding in 2011 and hurricanes in 2017. This meant that insurers were able to cover their losses thanks to reinsurance contracts from Munich Re, protecting themselves against financial risks in the long run.

Top Reasons to Modernize and Automate Reinsurance

The reinsurance sector has evolved parallel to the advancements in technology and the industry’s growing complexity. Traditional practices revolving around manual and paper-based operations aren’t efficient enough to handle the complex tasks of reinsurance. A key example is increasing regulatory requirements, which necessitate a shift towards automated systems capable of real-time data analysis. Let’s deep dive into the issues that insurers face when they use legacy reinsurance systems and the benefits of a modern, automated reinsurance system.

5 Issues with Legacy Reinsurance Systems

Legacy reinsurance systems, while foundational, have inherent issues that impede operational efficiency and accuracy in today’s fast-paced, data-driven world. Below are the specific challenges presented by these outdated systems.

-

Lack of Flexibility

Legacy systems are incapable of implementing new functionalities and responding quickly to new market demands. This lack of adaptability hinders the growth of reinsurance companies in an ever-evolving market.

-

Increased Risk of Errors

Manual or semi-automated systems are susceptible to human errors. Data entry or calculation mistakes can lead to significant financial losses, misunderstandings, and regulatory compliance issues.

-

Impediment to Real-time Data Access

Legacy systems do not provide real-time access to data. Delays in accessing accurate data can result in missed opportunities and increased risk of errors.

-

Absence of a Single Source of Truth

Legacy systems were not developed to provide a single source of truth. This lack of a unified data repository leads to discrepancies and data redundancies.

-

Dependency on Legacy System Maintenance

Insurers heavily depend on SMEs to support legacy system maintenance. With multiple disparate systems required to run, the dependency on these experts increases the cost of maintaining these systems.

See Also: Download our whitepaper to learn how antiquated reinsurance management systems impact insurers and the alternative that would drive business growth and reinsurance program success.

3 Advantages of Technology Integration into Your Reinsurance Software/Process

As we move towards an increasingly digital world, integrating technology into reinsurance software and processes isn’t just beneficial; it’s essential. Here are some key advantages that technology brings to the reinsurance landscape.

-

Real-Time Data Processing

Integrating technology into reinsurance processes allows for real-time data processing. This eliminates delays associated with manual methods and enhances decision-making by offering instant access to up-to-date information.

-

Advanced Analytics

Technology integration provides deeper insights into reinsurance contracts and claims. This empowers companies to make data-driven decisions and strategize more effectively.

-

Automated Processes

Automation reduces the risk of human error and increases overall operational efficiency. Repetitive, time-consuming tasks such as data entry and report generation can be automated, saving time and resources.

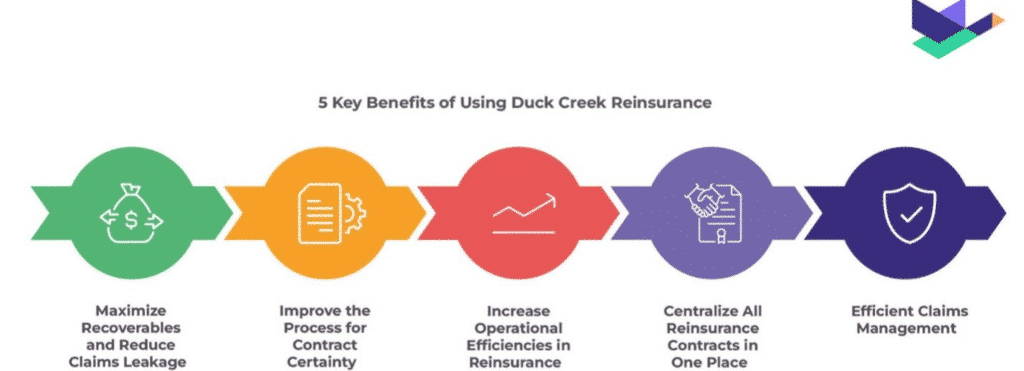

5 Key Benefits of Using Duck Creek Reinsurance

Duck Creek Reinsurance offers a comprehensive solution to the challenges posed by traditional reinsurance practices. Let’s delve into the key benefits of implementing this robust system.

-

Maximize Recoverables and Reduce Claims Leakage

Duck Creek Reinsurance helps insurers accurately calculate recoveries, rapidly create reinsurance bills, and identify all claims intended to be covered by reinsurance. This significantly reduces claims leakage and maximizes recoverables.

-

Improve the Process for Contract Certainty

With Duck Creek, reinsurers and brokers can leverage data to make critical decisions regarding risk appetite and support reinsurance contract negotiations. This greatly improves the process of achieving contract certainty.

-

Increase Operational Efficiencies in Reinsurance

Duck Creek facilitates automation, standardization, and data transparency. This creates a more efficient and productive reinsurance administration program, enhancing operational efficiencies.

-

Centralize All Reinsurance Contracts in One Place

Duck Creek allows insurers to centralize all their reinsurance policies on a single platform. This provides greater visibility, security in data processing, and efficient management of reinsurance contracts.

-

Efficient Claims Management

Duck Creek offers an efficient way to manage all claims and events in reinsurance. Insurers can easily view and update the status of their claims at any time.

4 Standout Features of Duck Creek Reinsurance

Duck Creek Reinsurance stands apart in the market with its distinctive, state-of-the-art features designed to streamline and simplify reinsurance processes. Here are the standout features that make Duck Creek the preferred choice for modern reinsurance management.

-

Comprehensive Contract Management

Duck Creek Reinsurance centralizes all types of reinsurance policies in one platform, providing an easy-to-navigate schematic view. It allows for efficient handling of renewals by copying existing contracts and their terms. This comprehensive contract management feature allows insurers to significantly reduce administrative time and effort, enabling them to focus more on strategic decision-making.

-

Efficient Claims Management

Duck Creek provides a centralized platform to manage all claims, events, and their statuses. It automatically determines the optimal period for retroceded amounts through an hours clause. The efficiency of this claims management system reduces processing times and increases the accuracy of claims handling, resulting in greater customer satisfaction and reduced financial risk for insurers.

-

Automated Accounting

Duck Creek streamlines all technical and financial accounting with its robust calculation engine. It supports all account types and automates report production for partners. This automated accounting feature reduces the risk of human error in financial reporting, ensuring accurate and consistent financial data, which is crucial for insurers’ compliance and decision-making processes.

-

Advanced Reporting

Duck Creek offers turnkey and configurable reporting options with statistical and dynamic reports modules. It allows third-party tool connections for extensive data analysis and supports various output formats and automated regulatory reporting. With the advanced reporting feature, insurers can gain deeper insights into their business performance and market trends, facilitating more informed strategic planning and forecasting.

Real-life Application: Case Studies

FBL sought out Duck Creek Reinsurance to streamline manual processes and strengthen internal controls to mitigate reinsurance-related risks and expedite their reinsurance claims processing.

With Duck Creek Reinsurance, FBL was able to access the automatic application of complex reinsurance terms and calculations, including catastrophe treaties. This solution also helped FBL streamline data collection while integrating seamlessly with financial and regulatory reporting systems, simplifying the insurer’s Schedule F preparation.

FBL was then able to streamline their reinsurance processes, have enhanced control over reinsurance calculations, and enjoy faster billing and claims recovery. Read more about how FBL utilized Duck Creek Reinsurance here.

Duck Creek: The Complete Reinsurance Management Solution

Duck Creek Reinsurance tackles data struggles, improves operational efficiency by reducing manual labor, provides better risk assessment and decision-making through real-time data access, and helps insurers save costs due to reduced errors and improved processing speed.

Ready to streamline your reinsurance management with Duck Creek Reinsurance? Contact us today for more information on how we can help transform your business. Now is the time to modernize and automate your reinsurance processes, and Duck Creek Reinsurance is here to help you do just that. Don’t let legacy systems hold you back from achieving greater operational efficiency and profitability – make the switch today.