Industry analyst firm Novarica recently released its annual Market Navigator report on Property and Casualty Policy Administration systems, an exhaustive review of PAS products and full suites available to P&C insurers in the United States. While the report does not offer subjective analysis, it does offer a close look at the functionality and key differentiators of Duck Creek Policy. A number of Novarica’s observations in this report reflect just how flexible and functionally rich Duck Creek Policy is; we’ve taken some highlights from the report to present an overview of Policy here, and you can download the full report to read more.

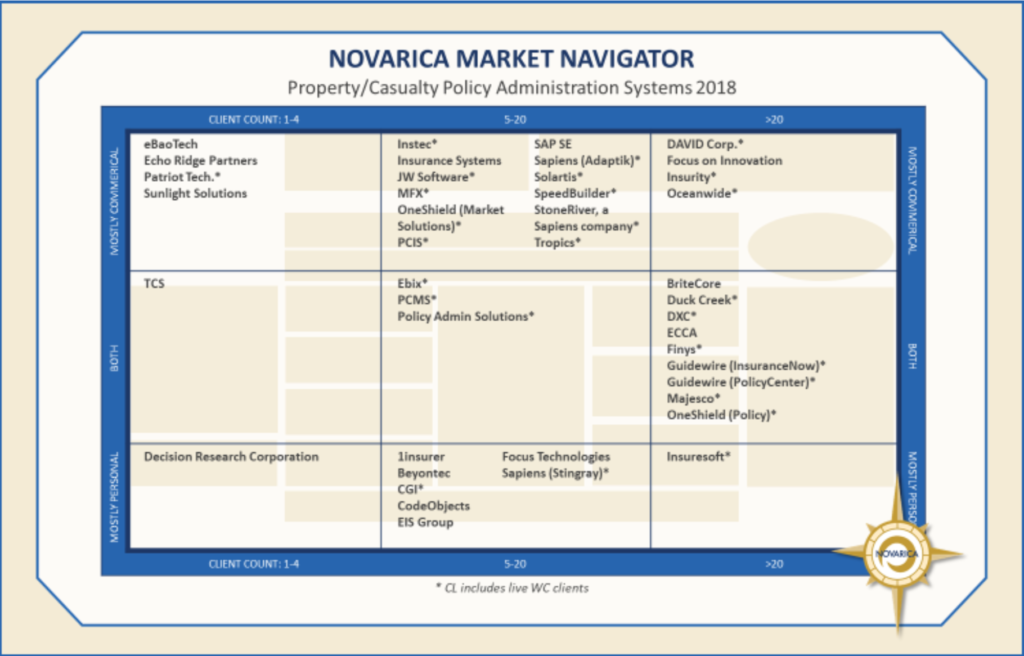

The report begins with a graphical representation of PAS solutions in the marketplace, indicating which lines of business are typically supported and the number of insurers using each solution:

Duck Creek Policy’s position on this chart shows that it has enjoyed widespread adoption, with equal appeal to personal and commercial lines insurers.

Duck Creek Policy’s position on this chart shows that it has enjoyed widespread adoption, with equal appeal to personal and commercial lines insurers.

Indeed, Novarica goes on to note that Duck Creek Policy supports all personal and commercial lines of business:

The report also notes important trends driving carriers to replace their policy administration systems. Among them, these three are common themes we encounter in the market, and ones Duck Creek Policy was built to address:

The report also notes important trends driving carriers to replace their policy administration systems. Among them, these three are common themes we encounter in the market, and ones Duck Creek Policy was built to address:

· The need to improve product development speed—and enhance product capability—to pursue new opportunities (e.g., excess and surplus lines, workers’ comp), or to accommodate market demands (e.g., micro-rating, direct-to-consumer), especially as carriers continue to engage in M&A.

· The need to improve product development flexibility to enter profitable new niches as the commercial market continues to harden and the economy continues to improve, and as the personal auto market looks to enter other areas in preparation for external disruption.

· A desire to find more cost-effective ways to support the ongoing operation and management of core-systems capabilities. In some cases, this may mean a move away from systems that require customization for enhanced functionality or capability and toward systems that use configuration tools to achieve such enhancements. In all instances, the objective is to reduce long-term total cost of ownership.

The need to improve product development and enhancement speed is perhaps the pain point we hear the most when we talk to carriers about replacing their core systems. And this is an area where codeless configuration, an inherent strength of the Duck Creek Platform, can make a crucial difference to carriers tethered to legacy systems that require extensive coding projects to change products or launch new ones. With codeless configuration, business rules and product definitions can be changed in minutes, not days or weeks – and by business users, not developers.

Indeed, as noted in this report, “Duck Creek Policy is browser-based for all user interface functions. The solution offers mobile capabilities through an HTML5 user interface optimized for mobile use. Clients are not allowed to touch core code. Duck Creek Policy’s configuration tools are designed to be used by non-IT staff. Configuration for insurance products, screens, workflows, rules, interfaces, and document authoring is via tools intended for IT analysts, BAs, and the average business user.”

And, of course, eliminating costly development projects frees up carriers’ IT budgets to pursue new opportunities and innovations, rather than simply “keeping the lights on.”

To dive deeper into this comprehensive report from Novarica, download your copy today.