Property and casualty insurers face ever-changing challenges and opportunities in a future defined by innovation and speed. For the successful carrier of tomorrow, the question of cloud delivery is no longer if, but when – and more importantly, how – to transition from legacy systems to a modern delivery model.

The three main models of cloud service are Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Years ago, it was common to find on-premises systems at most companies, meaning that the software was installed within the same building as the company. Now, more and more insurers are migrating toward cloud computing. But how are these models built, and which is the right one for you? We’ve compiled a comprehensive guide, including the pros and cons, explanations, and examples of each.

What is IaaS?

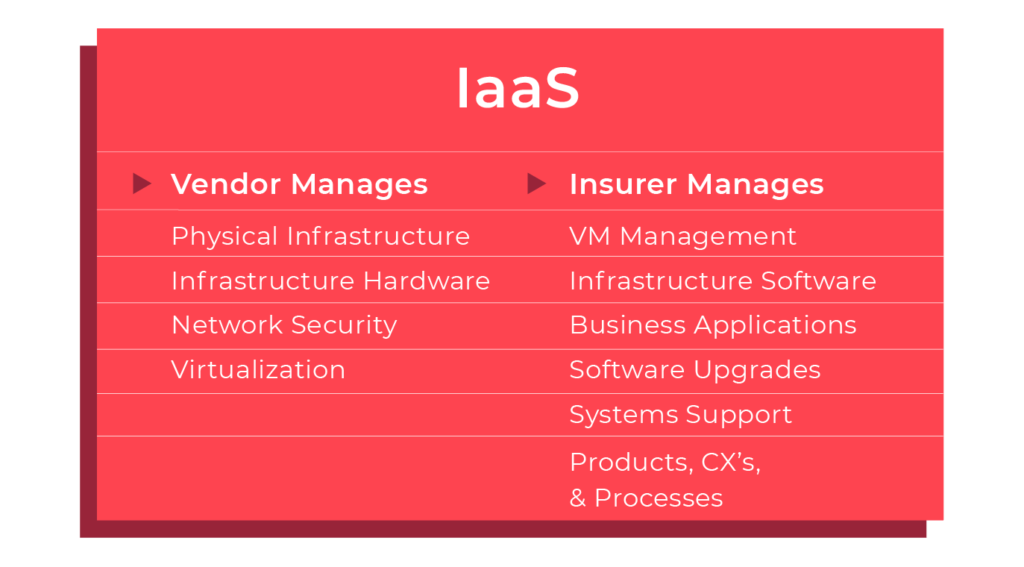

IaaS lets carriers outsource physical infrastructure, physical and network security, and virtualization. It is the simplest of the cloud hosting models available today. Think of it like an on-premises install at a different location (the IT model you are probably accustomed to without the hosting pains). IaaS has the added benefit of a few critical responsibilities being taken over by the hosting vendor, but more is left to the responsibility of the insurer.

What does IaaS do?

IaaS assists companies by building and managing their data as they expand. Companies pay for the storage space they need, but don’t have to host and manage on-site servers.4

Characteristics of IaaS

- Scalable services

- Easily adaptable

- Many users on a single piece of hardware

- Organizations are responsible for virtualization management

- Cost varies depending on consumption

When should you use IaaS?

Companies that are growing quickly may choose IaaS for the scalability. Others may opt for this delivery model if they wish to keep total control over their applications and managing the virtual infrastructure.

What are the pros?

First and foremost, moving from an on-premises system to a cloud-based model is an upgrade for any insurer. With IaaS, you gain the physical and network security and efficiency benefits of cloud hosting. Additionally, an IaaS model allows for more scalability than traditional physical hosting, so your applications can grow in concert with your operation.

What are the cons?

While IaaS does mean moving to the cloud, it is the least comprehensive of these three solutions. When comparing IaaS vs. PaaS vs. SaaS, IaaS leaves insurers responsible for most of the IT work. IaaS requires that carriers use IT teams to manage most of the company’s processes and systems. The insurer is also responsible for continuing much of the day-to-day work that makes on-premises solutions slow and costly.

What are the limitations?

IaaS, SaaS, and PaaS models all have similar limitations, including security, vendor lock-in, customization challenges, and cost overruns. One IaaS-specific limitation is legacy systems operating in the cloud. A legacy system refers to an older method, technology, or system (or one that’s considered outdated) that is still being used. Customers can run legacy apps in the cloud, but the infrastructure may not support the security, which means that improvements to the legacy apps may be needed.

Another limitation is that employees may need additional training when it comes to managing the IaaS infrastructure.

Download our eBook to learn what to ask vendors during the SaaS core systems RFP process.

What is PaaS?

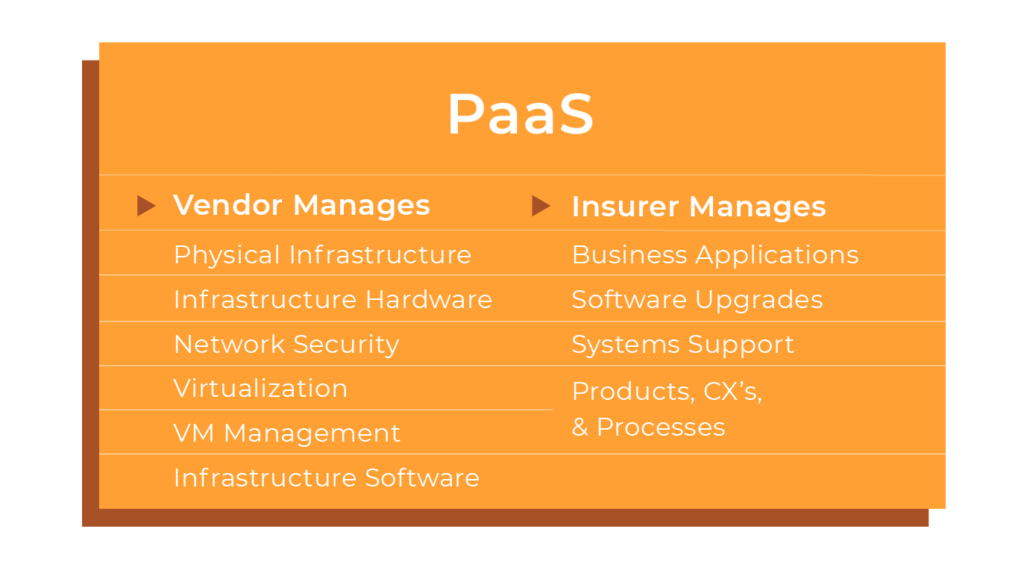

PaaS stands for Platform as a Service and equates to a middle-of-the-road outsourced cloud hosting environment. With PaaS, insurers outsource physical infrastructure, network security, virtualization, virtualization management, and infrastructure software maintenance.

What does PaaS do?

PaaS allows developers to build custom online applications without having to deal with data serving, storage, and management.

Characteristics of PaaS

- Scalable

- Easily accessible to multiple users

- Built on virtualization technology

- Easy to run without extensive system administration knowledge

- Incorporates databases and web services

- Provides a variety of services associated with developing and testing apps

When should you use PaaS?

PaaS is a good option if more than one or two developers are working on the same project and you are committed to building your own apps. Since PaaS can be fast and flexible, it’s also a good option if other vendors need to be included, and it’s helpful if you want to customize applications.

What are the pros?

A PaaS delivery model can work for carriers that are looking to focus more of their internal teams on insurance processes rather than IT infrastructure maintenance. Whether that means allocating more manpower to build new products or focusing on a stronger marketing plan to win new customers, PaaS can give you more flexibility to prioritize those goals. It can be more cost-effective than IaaS, and can keep carriers up to date on critical security updates.

What are the cons?

While PaaS does lighten the load in terms of in-house IT responsibilities, the two most labor-intensive and time-consuming aspects of maintaining your own systems remain the responsibility of the carrier’s organization. Upgrading software when necessary or advantageous as well as systems support across infrastructure, databases, and application will be left to the insurer, and both of those can be labor-intensive and costly.

What are the limitations?

Data security is one understandable concern when it comes to PaaS. Even though insurers can run their own apps and services, the data lives in third-party, vendor-controlled cloud servers.

The ability to integrate easily with existing services and infrastructure may also pose a cause for concern. Other limitations include vendor lock-in, customization of legacy systems, runtime issues, and the limit of operational capabilities for end users.

What is SaaS?

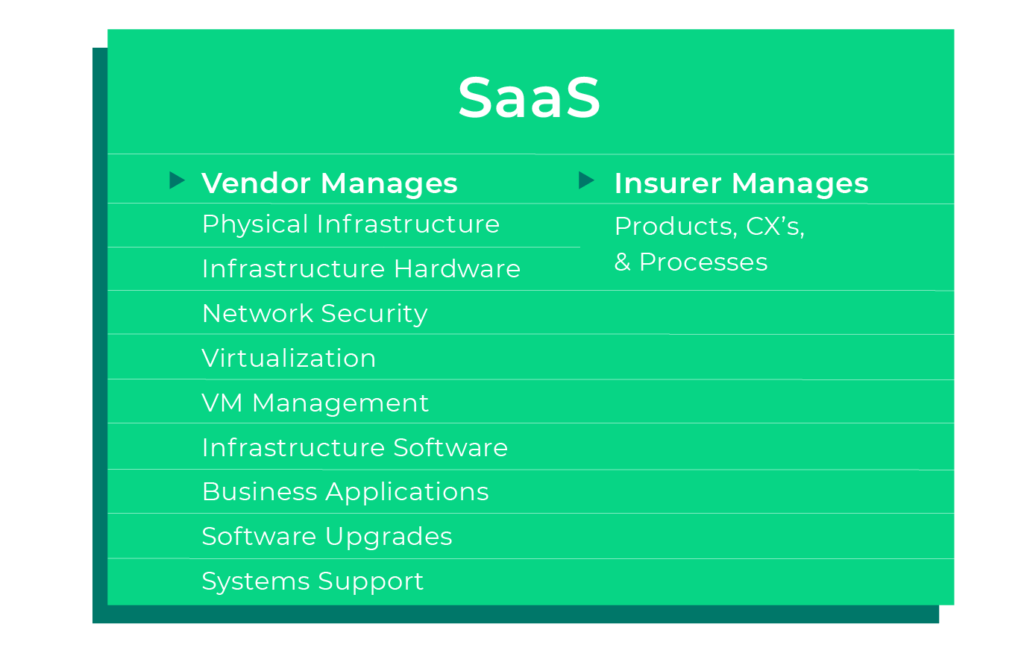

When comparing IaaS, PaaS, and SaaS, SaaS quickly emerges as the most comprehensive cloud delivery model available, as a true SaaS provider will manage every aspect of an insurer’s core systems save for the carrier’s insurance products, customer experiences, and business processes themselves. Software as a Service is the least resource-intensive cloud delivery solution for P&C insurers. With SaaS, server maintenance, platform management, system upgrades, and systems support are handled directly by the vendor, and the vendor provides insurance-specific software — fully outsourcing the most challenging aspects of maintaining core systems.

What does SaaS do?

The SaaS cloud delivery model is a popular choice that companies use to build and grow. Not only is the model easy to use, but it’s scalable and doesn’t need to be installed on individual devices, which means it’s ideal for companies whose employees are geographically dispersed.

Characteristics of SaaS

- Hosted on a remote server

- Attainable over the internet

- Vendor handles upgrades and helps keep customers current

- Infrastructure and systems support provided by vendor

When should you use SaaS?

SaaS is a good choice for applications that need to be accessible both remotely and through the web. It’s also beneficial for short-term, collaborative projects and startups or small companies that want to get moving and don’t have time for issues or developing their own software. SaaS not only is applicable to startups, but to companies of all sizes, providing the benefits of speed and agility to take advantage of market opportunities quickly.

What are the pros?

It’s all upside with a SaaS solution — the stress and hours of work required to run core systems are officially “outsourced,” freeing carriers up to focus on all other aspects of the business. It can save insurers the most time and the most effort and often is the lower total cost of ownership over time. With a comprehensive SaaS platform, creating new products and user experiences — and getting them to market faster than your competitors — is easier than ever because the majority of the associated IT responsibilities are in the hands of a software provider.

The advantages of SaaS are amplified as your own organization’s internal resources shift further away from systems administration and support toward finding new ways to innovate and to win and retain customers.

What are the cons?

Despite ample documentation of the security available in top-tier cloud hosting environments, some people may still be wary of migrating essential operations to a cloud-based system. A key to overcoming this objection when moving to a SaaS platform will be educating internal stakeholders on the value and security of modern SaaS solutions. SaaS solutions go beyond physical security, and provide additional layers of protection typically including managing endpoint protection, vulnerability scanning, system penetration testing, and access control. When searching for the right vendor, it is imperative that you do proper research, ask the right questions, and find the right solution for your organization’s unique needs.

What are the limitations and concerns?

As with PaaS, so-called “vendor lock-in” can be an issue, as some vendors make their services easy to join but difficult to get out of. Therefore, it’s important to make sure your organization’s intellectual property (IP) is separated from the SaaS provider’s core code so that you can protect and extract your IP as needed.

Another concern with the SaaS cloud delivery model is the ability to integrate with existing apps and services if the app is not designed properly. Also, the SaaS vendor may offer limited support when it comes to integrating with on-premises apps, data, and services.

SaaS solutions may also not provide insurers with their desired level of control since most aspects of the solution are handled by the third-party service provider.

Lastly, while data security is another concern since there’s often a large exchange of transferred sensitive information to the backend data centers of SaaS apps, the rigor of today’s cloud providers is far superior than what most corporations can accomplish in securing their own server rooms. Public cloud providers such as Microsoft Azure support over 90% of the Fortune 500; when you combine the levels of physical and network security they provide with the additional controls SaaS vendors will layer on top of that, you can have peace of mind that your data is highly secure.

Which model is right for you?

IaaS vs. PaaS vs. SaaS is not so much a debate about which model is superior, but rather an imperative to understand what your business will be directly responsible for in each scenario. Successful carriers, now and in the future, need comprehensive, scalable, and adaptable cloud systems, allowing them to focus their resources on the things that matter most – their products and customers. By assessing your needs and matching your desired business outcomes to each of these potential models, a clear path forward will emerge.