It’s no secret that personalized insurance offerings and services are one of the biggest differentiators for insurers, as some 80% of customers have come to expect from their insurance company. One of the most obvious and essential areas insurers can personalize is the policy lifecycle.

It’s important to understand that not every customer’s experience with their insurer during the policy lifecycle will be the same. This means insurers need agile and flexible solutions that allow them to meet customers wherever they are, at whatever stage of the policy lifecycle they’re at.

The insurance policy lifecycle can have many stages, and when it comes to personalizing experiences, the following stages offer some exciting opportunities.:

- Policy Sales

- Underwriting

- Claims

Personalizing the Policy Sales Experience

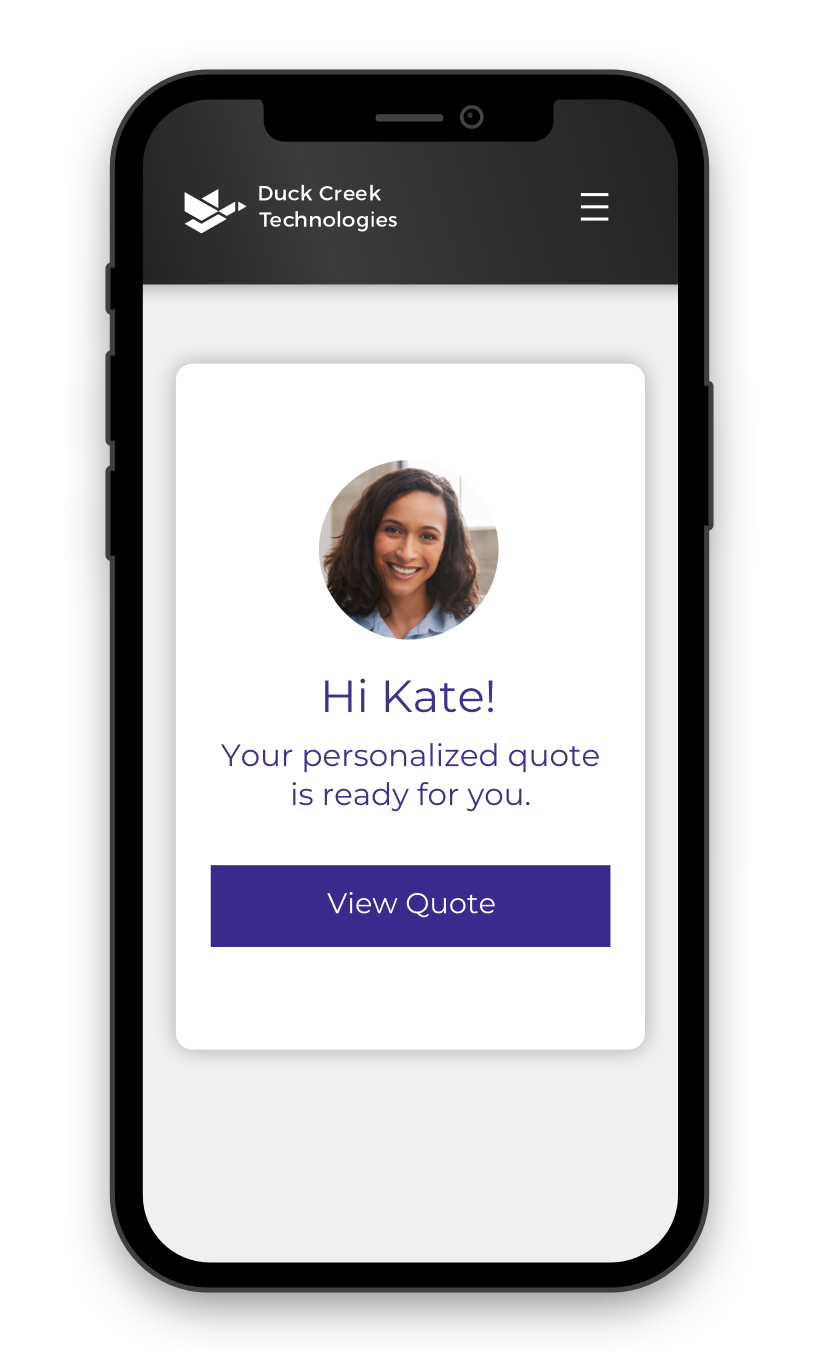

Today’s policy shopper is comfortable using a variety of digital channels to communicate with family and friends. They have come to expect the same level of comfort when shopping for an insurance policy. Fortunately, communication technologies have evolved rapidly over the cloud, giving insurance carriers the opportunity to engage with policy shoppers through their smartphones and laptop computers. In addition to real-time communication using voice and video over the cloud, a carrier sales agent can now assist shoppers research, apply for, and renew insurance policies using co-browsing, screensharing, instant messaging, AI, and chatbots. Click here to learn more.

Personalizing the Underwriting Experience

With evolving risks such as climate change and cyberattacks, and the ever-present threats of insurance fraud and social inflation, underwriting leaders are under pressure to accurately identify risk associated with personal and commercial policy applications, deliver optimal pricing, and reduce losses. Traditional underwriting processes that lack sufficient and relevant applicant data rely heavily on lengthy applications that are prone to error, delay quote delivery, and can potentially lose the applicant to competitors. When evaluating complex applications, the underwriter’s workday can get long, filled with pervasive doubt and concern about underwriting decisions that have been made without a clear grasp of the risks associated with policy application.

A robust solution to these challenges faced by the underwriter is now available. Carriers can utilize AI-powered predictive analytics to rapidly and reliably assess underwriting risk, direct applications with low risk to straight-through processing, and automatically route complex risk for underwriter review. With seamless access to the predictive analytics “engine” via integration with the carrier’s core system, the carrier can deliver a quote and bind a policy in minutes rather than days. Click here to learn more.

Personalizing the Claims Experience

The claims engagement experience of the policy holder who suffers a loss event can make or break the relationship between the insurance carrier and the policy holder. Like the policy shopper, the policy holder making the claim wants questions answered, and seeks transparent, timely responses, made urgent by the stressful nature of a loss event. Adjusters and claims agents, on the other hand, must respond to impacted policy holders in a manner that maintains the trust of the policy holder, addresses their concerns, and resolves the claim in the shortest time possible.

The complexity of most claims processes makes meeting these goals a challenge. A poor customer experience often results from miscommunication that can increase the cost of servicing the claim, and the loss of the policy holder to a competitor.

This is where the integration of SaaS-based core insurance platforms with intelligent communication platforms delivers real value. Adjusters, claims agents, and other claims stakeholders can utilize the multi-channel communication capabilities available with the integration to deliver a high-quality engagement to policy holders.

All stakeholders can communicate with each other over an omnichannel hub, across SMS, mobile apps, websites, and other channels. Messages can be directed to targeted individuals or to groups, and the carrier can receive all inbound communications initiated by the policy holder. In many cases, a transcript of all communications between the policy holder, adjuster, and/or claims agent can be saved for review by claims supervisors. Click here to learn more.

Personalized Products with Duck Creek

With Duck Creek OnDemand and our extensive ecosystem of solution partners and system integrators, Duck Creek helps insurers deliver personalized experiences throughout every stage of the policy lifecycle, meeting both policy holder and other stakeholders expectations at every touchpoint.