Humanized Insurance Technology enables people to connect with each other through the insurance lifecycle, in real-time, through channels that are highly personalized and connected experiences that empower people with insights and productivity.

News & Insights cards

“Price Walking” is the Thin End of the…

I’ve been following with interest the UK Financial Conduct Authority (FCS)’s recent …

10 Insurance Company Technology Trends Gaining Pace in…

Editor’s note: This blog has been updated in Oct 2023 for comprehensiveness. The …

11 Use Cases for Predictive Analytics to Drive…

According to McKinsey & Company, the usage of artificial intelligence and machine …

Resource Card

“Two Markets and One Technology Architecture” – A…

Bart Patrick, Managing Director of Duck Creek Technologies in Europe, participated in two …

More Bang for the Buck for Insurers

Efficient management of payment systems is crucial for insurers to maintain a competitive …

Keeping out of the Storm

Catastrophe reinsurance is a vital tool for insurers to manage their risk and capital in …

Testimonial Vertical

QBE a choisi Duck Creek pour gérer et centraliser tous les processus de réassurance. Avec Duck Creek Reinsurance, nous disposons d’une plateforme qui fournit une « source de vérité » pour les calculs de réassurance au sein de QBE, tant pour la réassurance cédée que pour la réassurance acceptée. Nous avons également estimé que Duck Creek correspondait bien à nos besoins et que nous serions en mesure de bien travailler avec leurs équipes.

Beazley a choisi Duck Creek Reinsurance, la plateforme de réassurance basée sur le cloud, pour ses solides fonctionnalités prêtes à l’emploi. Duck Creek a démontré son expertise en réassurance et sa capacité à gérer des projets de déploiement de plateformes de réassurance.

Testimonial Horizontal

Humanized Insurance Technology enables people to connect with each other through the insurance lifecycle, in real-time, through channels that are highly personalized and connected experiences that empower people with insights and productivity.

Testimonial with Video

Humanized Insurance Technology enables people to connect with each other through the insurance lifecycle, in real-time, through channels that are highly personalized and connected experiences that empower people with insights and productivity.

Icon with Content

Side-by-side (with link)

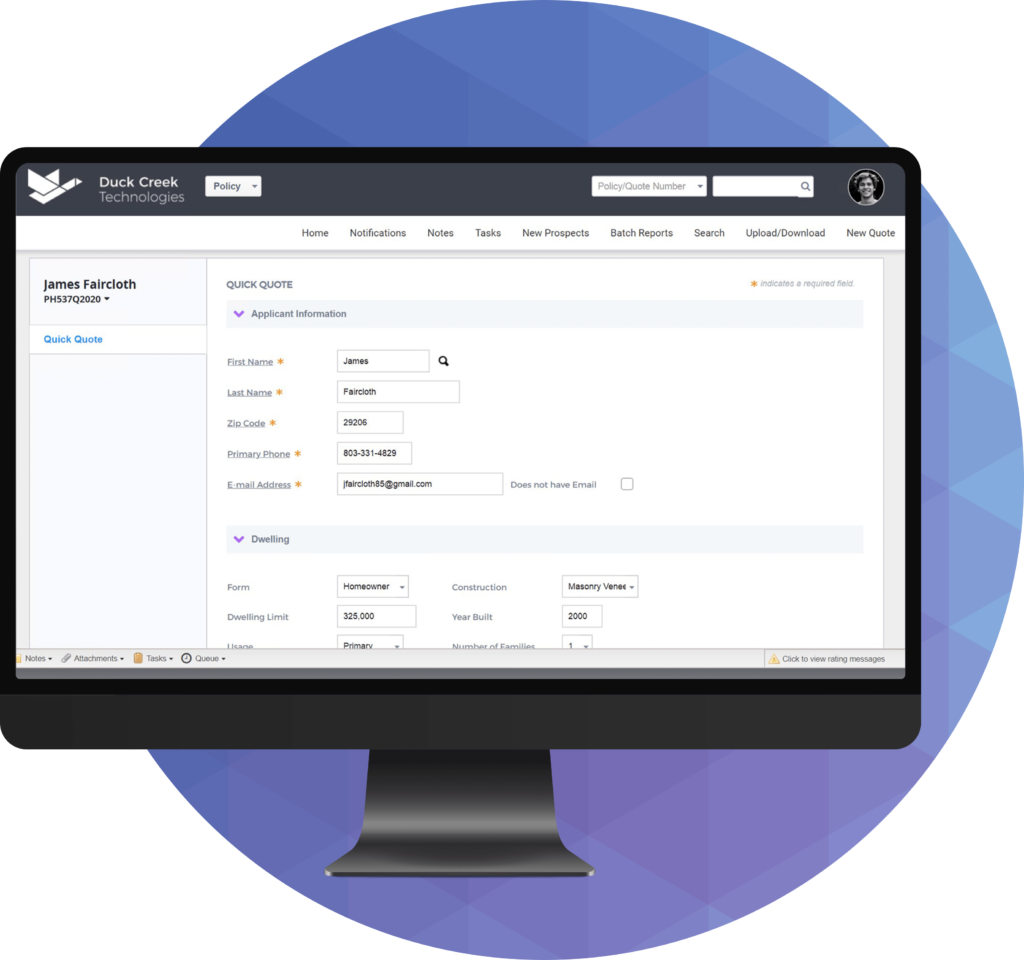

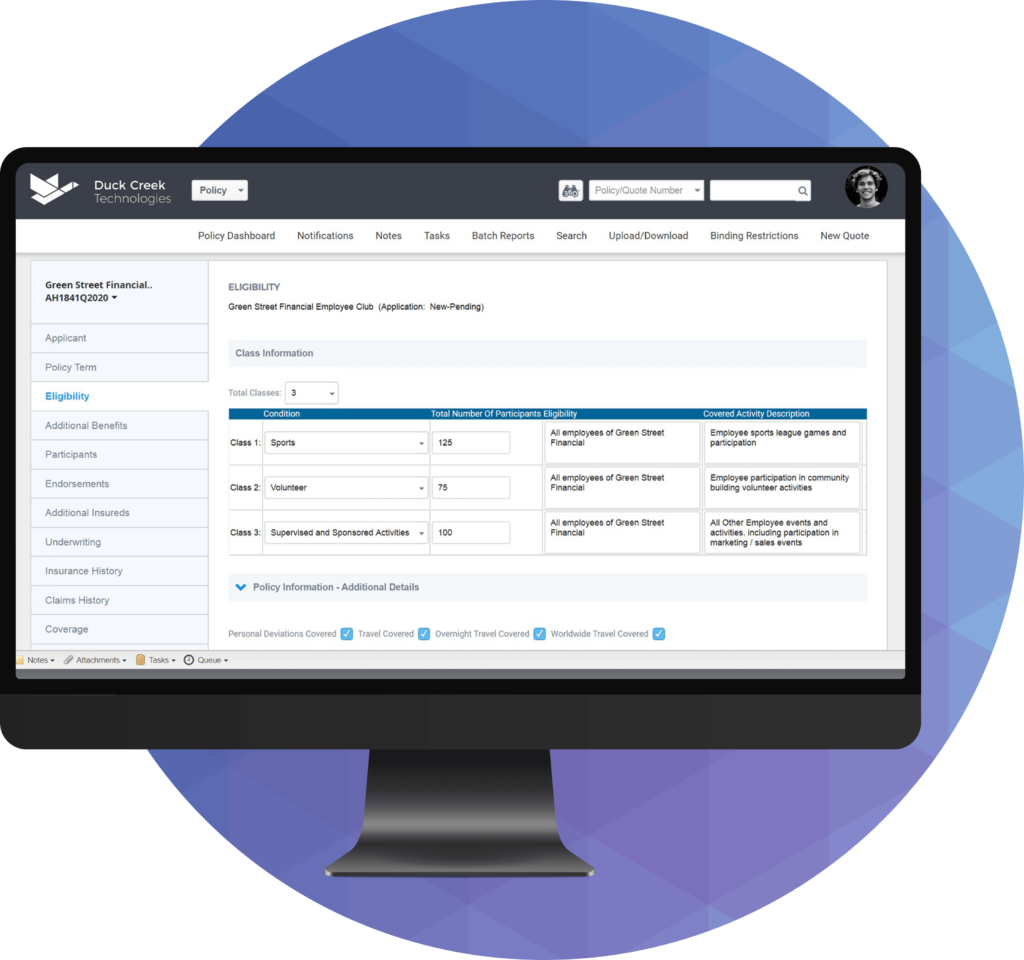

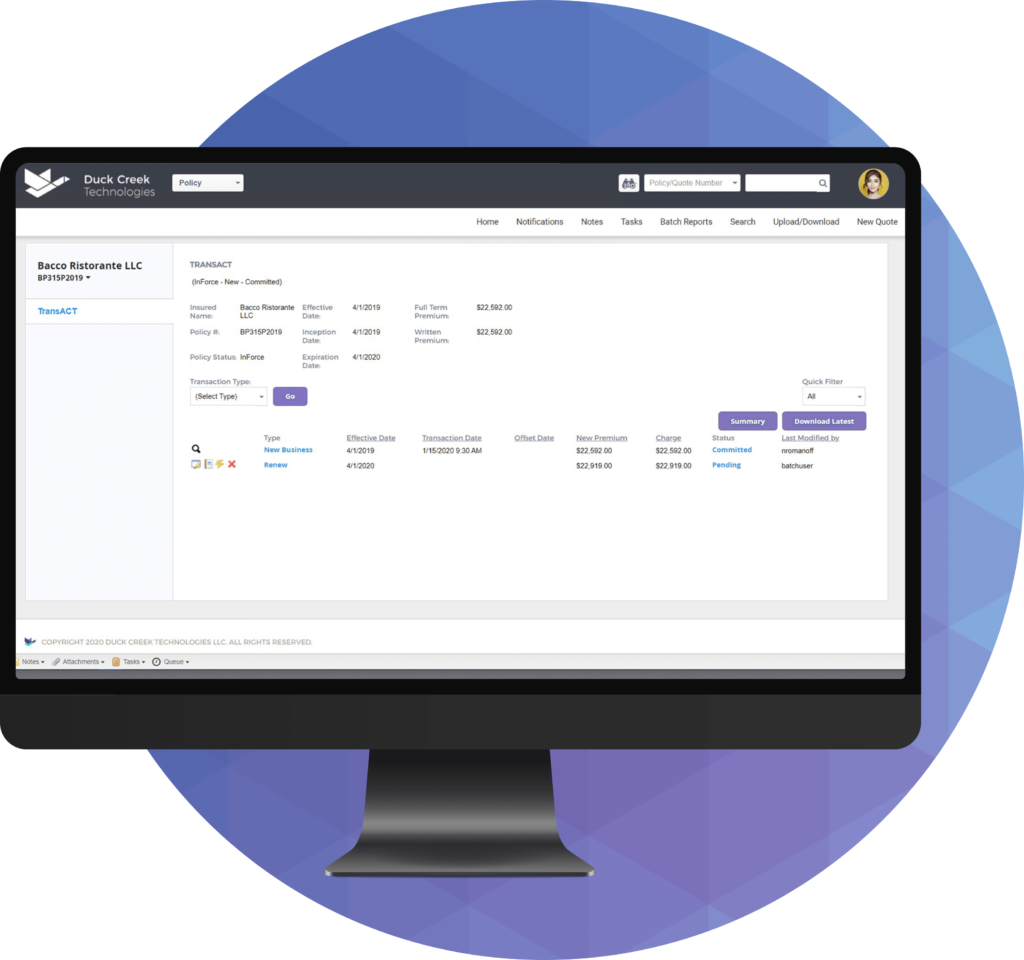

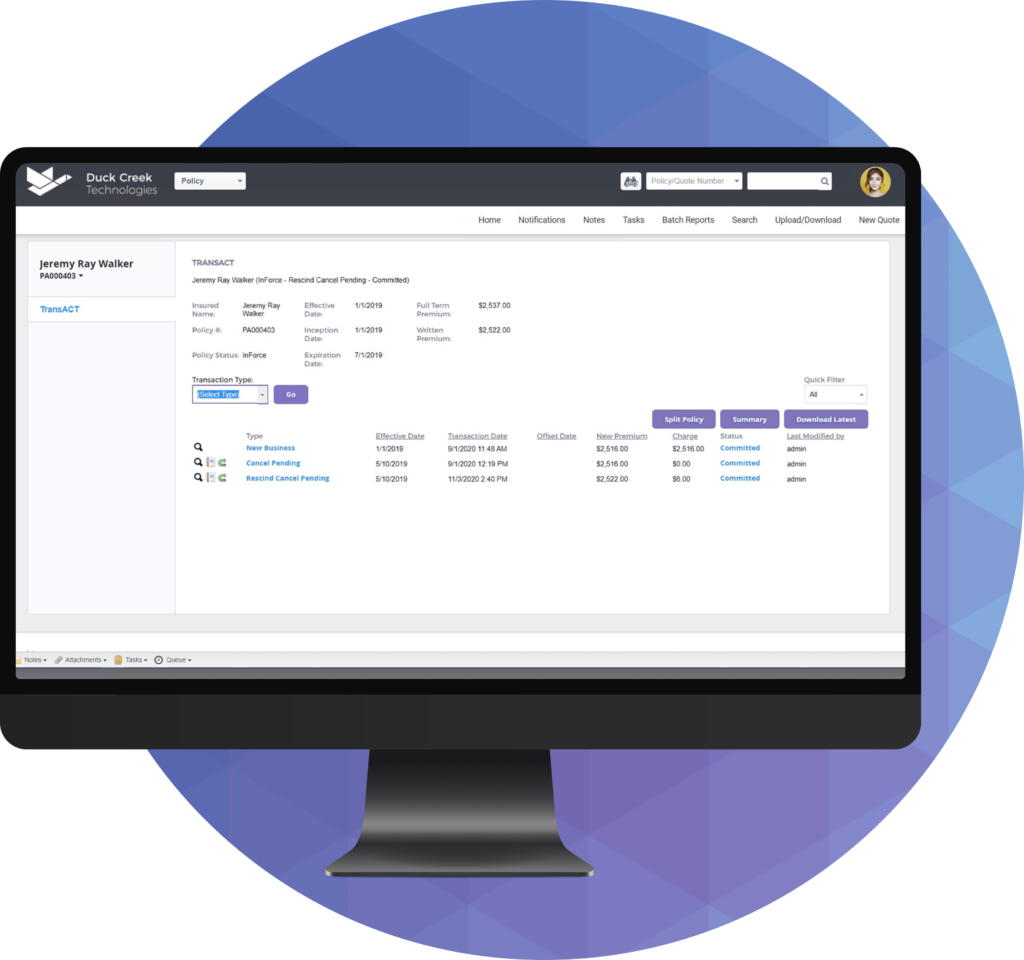

Policy

Customer needs are evolving rapidly. Duck Creek Policy is a powerful and flexible policy administration system that enables carriers to service the complete policy lifecycle.

Stacked w/ List and Button

Mergers & Acquisitions

- Sell-side M&A advisory

- Platform acceleration

- Divestitures and carve outs

Stacked: Centered

Empower your business users to drive change

Lorem ipsum dolor sit amet, ven consectetur adipiscing elit, sed do eiusmod tempor incididun.

Stacked Left Aligned

Learning Your Way

Choose from instructor-led training at a Duck Creek Technologies facility, on-site sessions at your location, or remote learning.

Wide Five Column Icon and Content

59

Countries where OnDemand Claims originated in 2019

70,000

Number of global users

20M

reduction in referrals through automated underwriting

4,000

increase in quotes

42,000

Number of claims per day our software has scaled to during a CAT event

Job Opening

Job Openings

| Position | Location | |

| Lead Business Architect | ||

| Server Database Service Associate – Database Admin | Mumbai, India | |

| Software Solutions Engineer III | Mumbai, India | |

| Senior Product Manager | Remote India | |

| Senior Financial Analyst | Columbia, SC | |

| Senior Software Engineer – .Net Claims |