P&C insurance is rapidly being reshaped by escalating risks, demanding a new era of intelligent operations. At the forefront of this transformation, Duck Creek is blazing a trail for the advancement of agentic AI, in collaboration with Microsoft.

While traditional manual methods of operations hit their limits fast, agentic AI transcends these barriers; orchestrating proactive, data-driven responses that rapidly adapt to evolving needs across the entire insurance value chain.

Here we explore a top priority use case for P&C carriers: catastrophe (CAT) modeling. Learn how Duck Creek’s collaboration with Microsoft is accelerating the power of agentic AI to help insurers master catastrophic risk – without sacrificing the unwavering quality that both carriers and customers prioritize above all else.

Why Traditional CAT Approaches Fall Short

P&C insurance carriers are confronting an escalating dilemma: an overwhelming volume of complex challenges relentlessly outpacing the capacity of traditional approaches. The sheer speed and scale of modern risks, particularly catastrophic events, mean there is simply too much to do with too little time for outdated methods to cope.

Without agile response and strategic foresight, carriers often find themselves mired in a cycle of inefficiency and reactivity, where foundational limitations become insurmountable hurdles.

This leads to a series of critical vulnerabilities across their operations:

- Reactive Posture: Instead of taking proactive steps to minimize impact, carriers are reacting and always playing catch up.

- Insight Deficit: Instead of making risk mitigating decisions, carriers are busy manually extracting, reconciling, and compiling raw data.

- Static Models: This outdated perspective is ill-suited to the real-time nature of CAT scenarios, leaving carriers vulnerable to mispriced policies and unexpected losses.

- Operational Bottlenecks: Legacy systems and manual effort are not built to scale to demand surge, forcing a reactive “triage-as-we-go” mentality.

- Strained Customer Relationships: Long wait times and inconsistent information erode trust, undermining the very purpose of insurance when it is needed most.

Enter Agentic AI: The Proactive, Adaptive Intelligence

Imagine an Artificial Intelligence (AI) that does not just automate tasks but autonomously plans and acts to achieve specific goals. This is agentic AI.

Agentic AI: A more advanced and specialized form of AI, this intelligent software is designed to process complex information, make informed decisions, execute tasks, and adapt to new experiences.

Unlike traditional AI that is constrained to a pre-defined workflow, agentic AI can proactively perceive the environment, identify patterns, predict outcomes, create multi-step plans, execute actions, and adapt or self-correct. AI agents are “smart” not just at tasks, but at intelligently pursuing complex goals and acting.

For P&C, this is not an upgrade; it is a fundamental change in how we approach risk.

Agentic AI for Insurance: Our Collaboration with Microsoft.

While the full transformation of insurance through AI is still unfolding, the path forward is becoming remarkably clear; AI is tables stakes, agentic AI is the competitive advantage.

At Duck Creek Technologies we are not just talking about the future; we are actively building and proving its foundations. We are thrilled to announce a collaboration that will redefine the future of Insurtech. For the past 20 years, we have been leading the charge in developing innovative solutions for the insurance industry. Now, we are combining our deep industry expertise and proven solutions with the unparalleled power of Microsoft and Microsoft Azure.

“Innovative P&C leaders are asking how to operationalize the promise of AI,” said Doug Smith, General Manager for US Financial Services at Microsoft. “Our collaboration with Duck Creek provides the answer: targeted, scalable applications of agentic AI to solve pressing business challenges. With Duck Creek’s deep insurance domain expertise and Microsoft’s secure and scalable end-to-end AI platform, Duck Creek is enabling carriers to improve profitability, increase growth, and effectively manage risk.”

Agentic AI: Mora for Proactive CAT Response

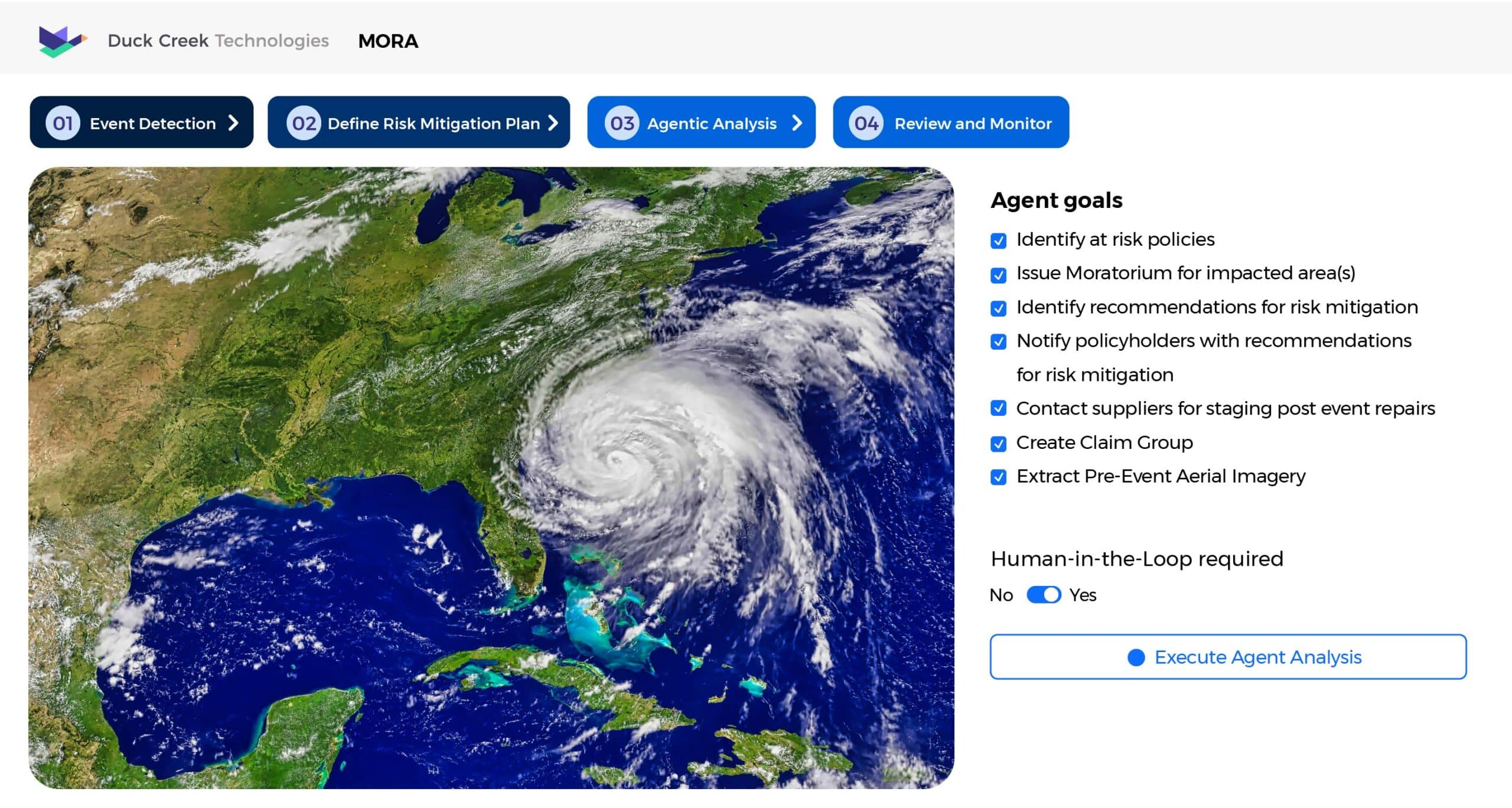

Our agentic AI assistant, Mora, is an early result of our collaboration with Microsoft: a real-world demonstration of how agentic AI will revolutionize how carriers identify, prepare for, and respond to catastrophic events.

Built with our AI platform, Duck Creek Intelligence, and Microsoft Azure, Mora merges deep insurance expertise with industry leading AI infrastructure to create a systematic, adaptive, and intelligent solution.

What is Mora?

Mora is an autonomous software system designed to continuously monitor, analyze, and support carriers in responding to CAT events. Mora orchestrates multiple AI agents to work together to achieve carrier-identified goals by using data from Duck Creek Clarity and public data. Mora is designed to be human-centric, surfacing insights and information for human review and approval prior to autonomously taking approved preparation and response actions.

How Does Mora Prepare for and Respond to CAT Events?

In a multi-agent AI system, the true power lies in its ability to orchestrate specialized sub-agents. The architecture and interactions amongst agents can vary by use case. A concurrent pattern is just one design pattern for AI agents that allows tasks to be executed in parallel with results collected and aggregated. Microsoft Azure’s extensive ecosystem provides the ideal environment for building and empowering sophisticated agentic systems.

At the core of this CAT event orchestration is Mora; endowed with a comprehensive understanding of the high-level objectives and outcomes. Mora’s sub-agents have been granted explicit access to datasets, APIs, and tools. This access is crucial as Mora fetches necessary data and delegates identified tasks to sub-agents.

When faced with a complex task, Mora first analyzes the overall goal, breaks it down into smaller, more manageable sub-goals, and then determines which specialized sub-agents are best equipped to handle each specific piece. These specialized sub-agents then execute their specific part of the plan, reporting their progress and findings back to Mora.

This dynamic delegation and resource utilization, all secured and managed within Azure’s enterprise-grade framework, ensures that each part of a complex problem is handled by the most appropriate AI component, working in unison to achieve the overarching business objective with speed, accuracy, and scalability.

Where Has Mora Been Tested?

To test Mora, we simulated a case study on how this AI could have been used by a P&C insurance carrier to coordinate a response plan to Hurricane Helene in 2024.

The emergency alerts blare across the region; an unexpectedly severe hurricane is making landfall. At insurance carriers, there is a different type of tempest. Spreadsheets, manual data entry, and disparate legacy systems quickly buckle under the weight of helping policyholders and protecting profitability.

Every minute spent on administrative tasks is a minute not spent analyzing at-risk policies, coordinating resources across supplier networks, or reaching out to stranded policyholders.

Mora Case Study Results: Prediction, Analysis, and Response

The Hurricane Helene scenario was designed to push the boundaries of traditional response: a simulated, large-scale catastrophic event impacting thousands of policyholders simultaneously. Where conventional systems would typically crack under such immense pressure, Mora demonstrated a truly transformative capability.

During this seven-day test, Mora did not just perform; it executed its functions with unparalleled precision and foresight, proving its ability to navigate chaos and deliver proactive results.

What followed was a clear demonstration of intelligent automation, dynamic adaptation, and seamless collaboration, validating Mora’s potential to redefine catastrophe management for P&C insurers.

In the wake of its deployment, Mora delivered tangible results that highlight its transformative capabilities:

- Predicted event severity and exposure

- Verified the event with NOAA

- Sent a notification to the carrier’s risk management team

- Collated critical information from public news and third-party partners across the Duck Creek ecosystem

At this point, humans defined the goals for Mora to achieve, including:

Based on human approval, Mora went on to independently perform analysis and execute tasks for each goal, dynamically adjusting the approach. Mora is designed to prioritize human-in-the-loop, by using human critical thinking to review, modify, and approve results, authorizing Mora to act.

Maximizing Customer Value Together

This collaboration is not just about integrating technologies; it is about forging a new path forward. Together, our vision is to build the future of Insurtech by empowering the property & casualty insurance industry with intelligent, agentic AI solutions that drive unprecedented efficiency and unlock new possibilities for growth and innovation.

This offers a compelling set of benefits for Duck Creek customers:

- Faster Innovation: Redirects R&D efforts to focus on unique insurance-specific breakthroughs.

- Faster Speed-to-Market: Accelerates availability of AI agents and speed to market by reducing the need for foundational development.

- Access to Cutting-edge AI: Leverages the latest and most powerful infrastructure and techniques.

- Most Recent Trends: Early access to future capabilities.

- Safe and Securable AI Environment: Delivers the highest standards of security, privacy, and integrity to mitigate risks.

- Comprehensive Cloud Platform: Handles vast amounts of data and fluctuating workloads, especially critical during peak periods.

- Specialized Capabilities for P&C Insurance: Tailors AI agents for insurance specific implementations.

- Future-proof with Scalability: Delivers a platform that grows with you as you scale and technology advances.

Conclusion

Mora highlights just a few AI agents successfully collaborating. Now imagine this level of support for every transaction across the entire insurance value chain. A dynamic intelligent orchestration unlocked by agentic AI with configurable human-in-the-loop controls to drive business outcomes. Purposeful, intentional, transparent, and deeply scalable.

With agentic AI, you are not handing over the reins; you are actively shaping the future of your insurance business.