Duck Creek Reinsurance

Centralize, Streamline, and Automate Your Reinsurance Processes

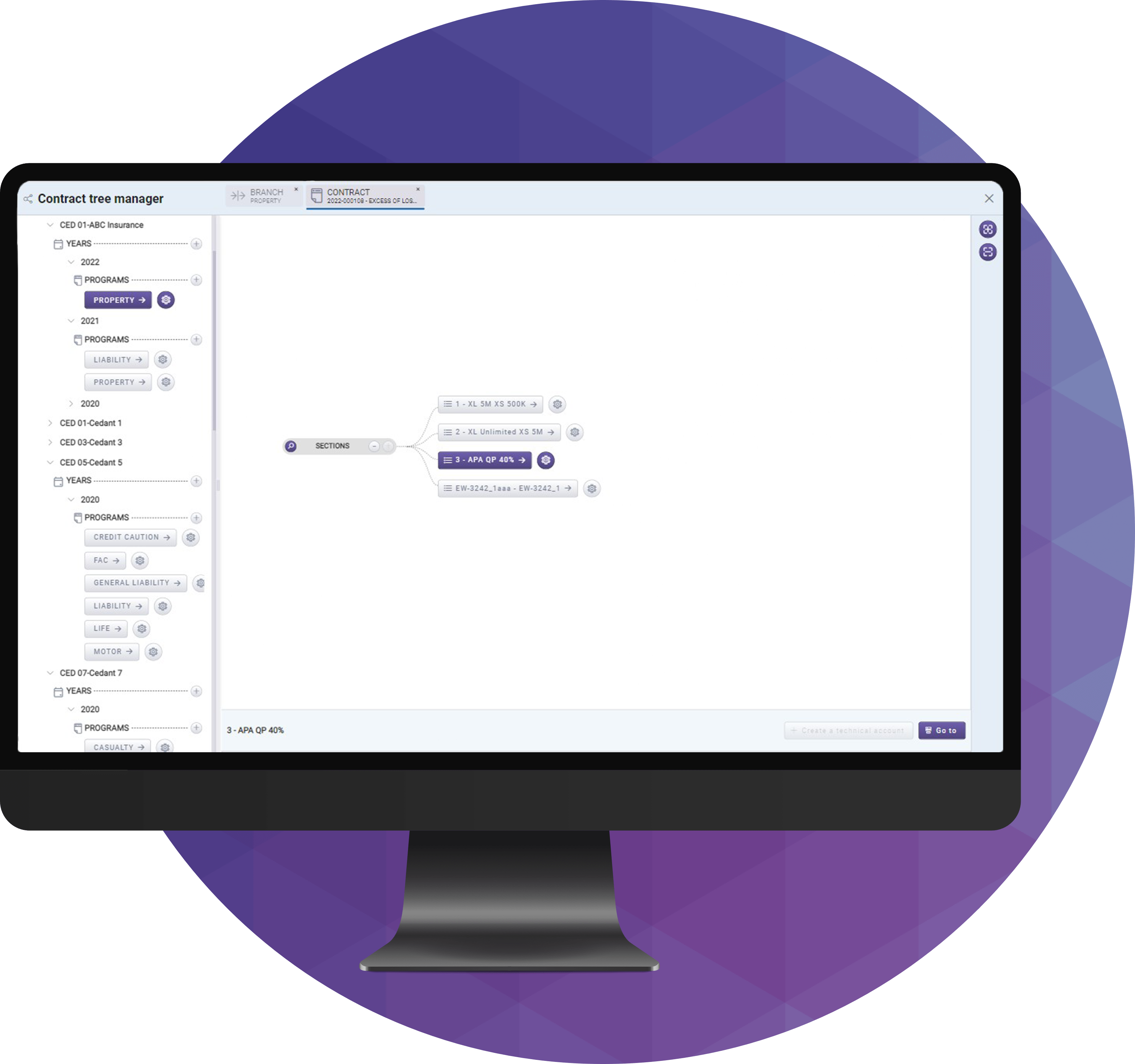

Whether you’re managing treaties or facultative contracts, get the control and clarity you need to reduce risk and scale across markets with ease. Manage all your contracts from underwriting to endorsements and renewals with a flexible solution that supports multi-currency operations and multi-GAAP and IFRS standards.

Benefits

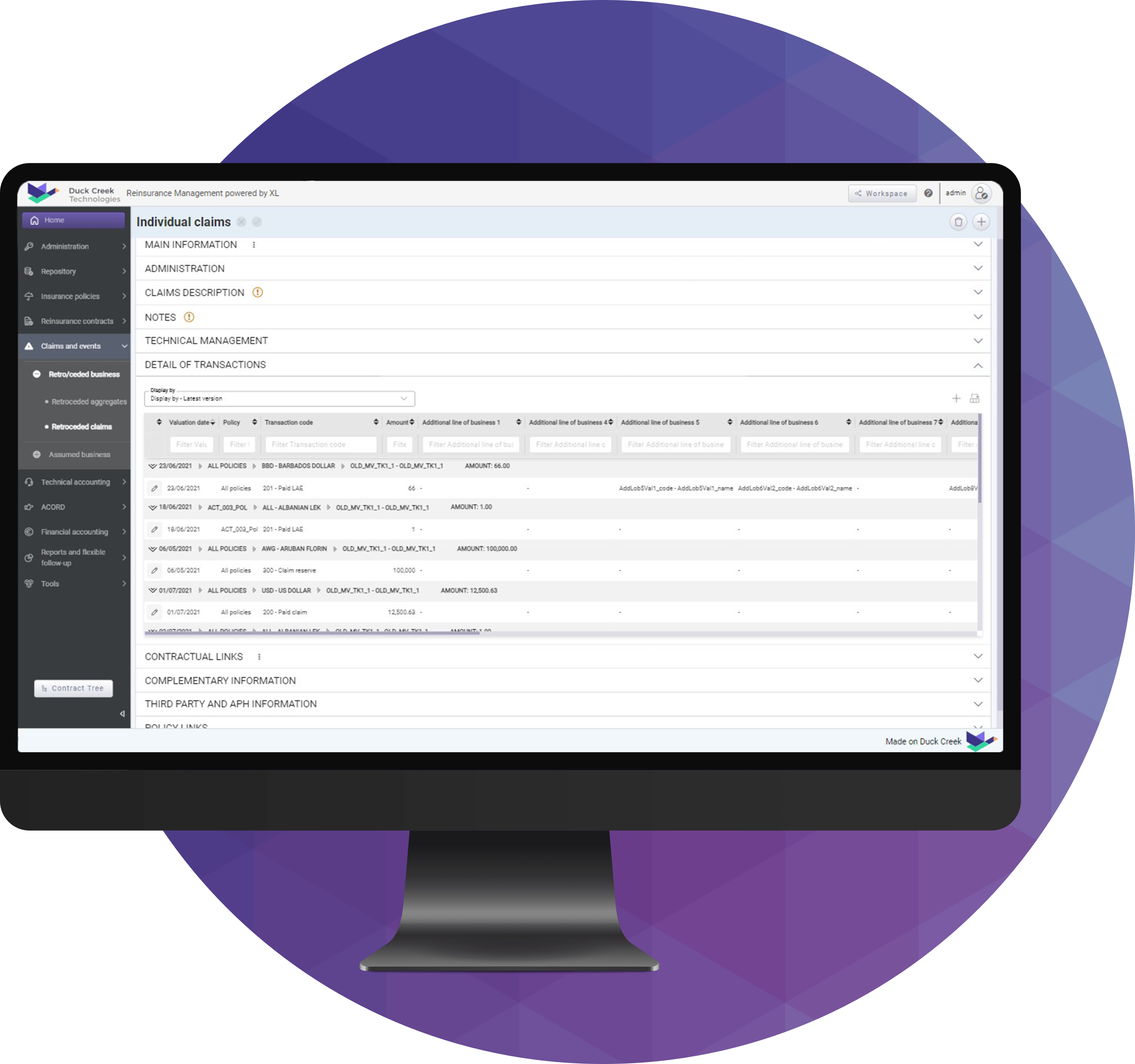

Maximize Recoverables and Reduce Claims Leakage

Identify all claims meant to be covered by reinsurance by accurately calculating recoveries, and rapidly creating reinsurance bills. Ensure all reinsurance ceded or assumed achieves its intended goals of helping reinsurers and brokers manage risks and making available the capital needed to support those risks.

Improve Process for Contract Certainty

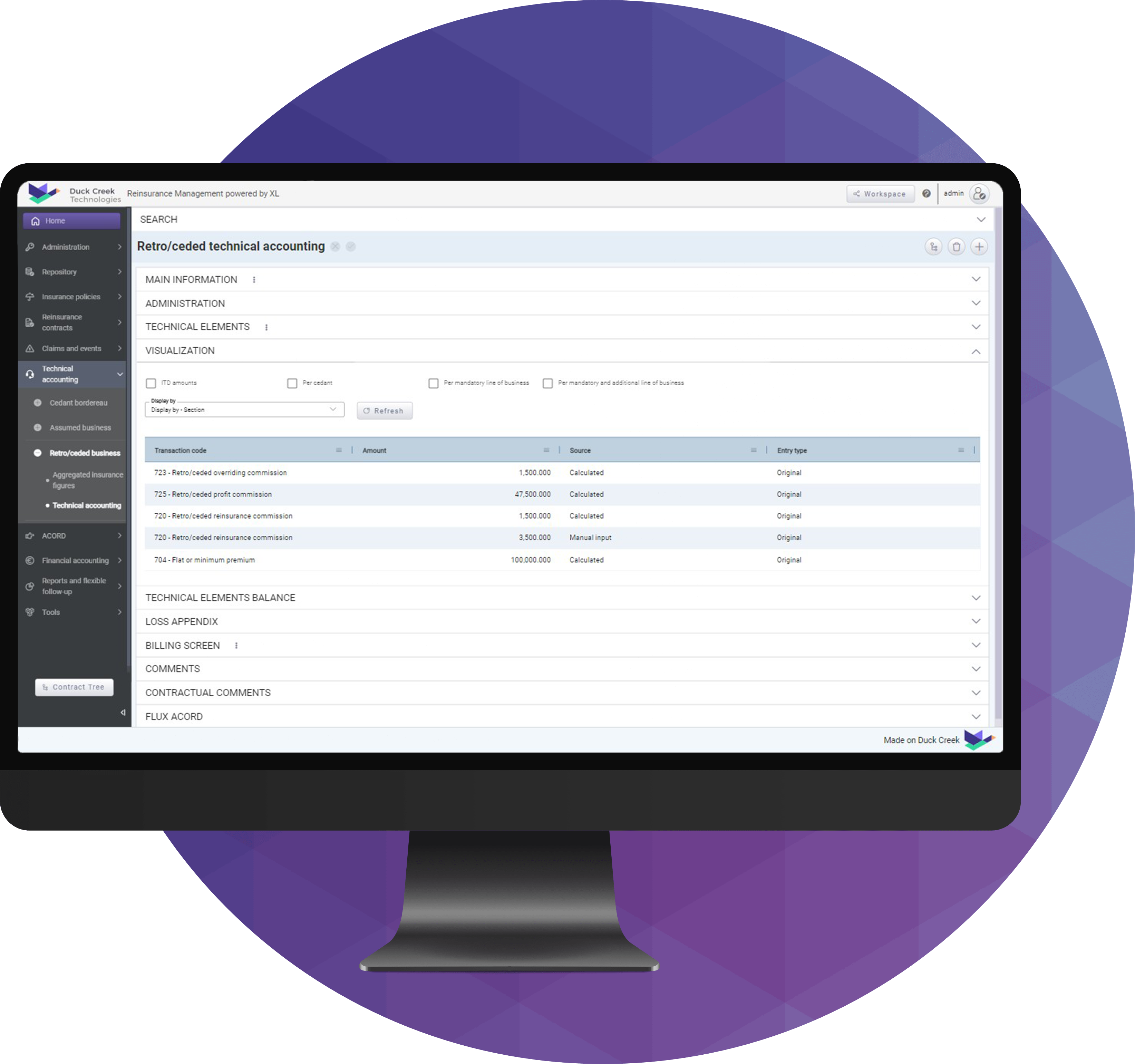

Digitally transforming reinsurance administration creates opportunities to strategically leverage data in ways that were previously extremely difficult. With the ability to better understand reinsurance transactions and outcomes, finance and risk management teams can leverage data to make critical decisions regarding risk appetite and support reinsurance contract negotiations.

Increase Reinsurance Operational Efficiencies

Transform complex reinsurance treaty administration productivity through automation, standardization, and data transparency for a more efficient and effective reinsurance administration program. Use our LORS integration to automate and simplify reinsurance ceding processes.

Key Features

Testimonials

Experience Smarter Reinsurance in Action

Whether you’re starting fresh, modernizing legacy systems, or looking to

make a digital transformation, our multi-faceted team of insurance and technology experts

can help get you there.

Useful Resources

Blog Post

How to Optimize Your Insurance Distribution Network for…

Insurance carriers rely on a vast, complex network of agents, brokers, MGAs, and intermedi…

Read More

Blog Post

Why Treasury and Reconciliation Are Draining Insurance Margins…

Most CFOs wouldn’t list treasury as a top strategic concern. It is supposed to be a …

Read More

Blog Post

SaaS Infrastructure, Backups, and DR: What Every P&C…

Speed is critical. But without resilience, it’s fragile. Deployment models that rely on …

Read MoreFrequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.