Insurance technology can be a highly cyclical industry. Over the last 30+ years of my career, I have seen quite a few cycles repeat themselves, sometimes more than once. Centralized mainframes gave way to distributed desktops, then back to centralized servers, and now back again to distributed endpoints with the adoption of cloud-based hosting and SaaS delivery models. Full-suite solutions versus best-of-breed components is another cycle I’ve seen both sides of. A few years ago, the pendulum swung toward full suites, but is it starting a backswing now? It’s a hard question to answer thanks to the advent of something that wasn’t even on P&C insurers’ radars just a few years ago: microservices.

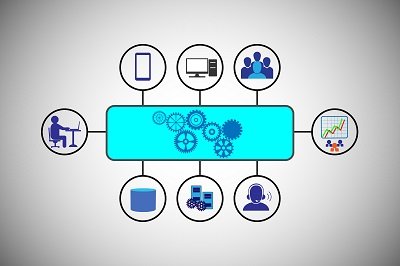

We are seeing a trend toward, and need for, service-based capabilities. For one example, many carriers are now seeking headless implementations of their core systems, which basically means they need the behind-the scenes capabilities of modern insurance core systems, but want to provide their own unique front-end user experiences. Another great example is the industry’s shift toward adopting microservices – isolated, single function services that integrate with carriers’ core systems as part of a broader vendor ecosystem – another sign that the pendulum of change is swinging again.

The need for specialized services is the calling card of the best-of-breed approach, but it is now applicable to full suites as well, thanks to platforms designed with open architecture that can connect with services and insurtechs to provide a robust offering on both the back and front ends. In fact, in a recent Celent report titled “Honey, I Shrunk the Services: Microservices in Insurance,” authors Craig Beattie and Tom Scales said that “While a microservices architecture isn’t appropriate for all computing tasks, it most definitely is of use in increasing speed of change and agility, and will form part of most future architectures in the insurance industry.” That the successful insurers of the future will need to adapt to change with agility and speed is hardly up for debate.

The need for specialized services is the calling card of the best-of-breed approach, but it is now applicable to full suites as well, thanks to platforms designed with open architecture that can connect with services and insurtechs to provide a robust offering on both the back and front ends. In fact, in a recent Celent report titled “Honey, I Shrunk the Services: Microservices in Insurance,” authors Craig Beattie and Tom Scales said that “While a microservices architecture isn’t appropriate for all computing tasks, it most definitely is of use in increasing speed of change and agility, and will form part of most future architectures in the insurance industry.” That the successful insurers of the future will need to adapt to change with agility and speed is hardly up for debate.

The strengths of one side of the cycles of change in insurance technology are usually counter to the strengths of the other. Isolated services and the best-of-breed approach allow great flexibility and power for a single service or component, but come at the cost of being… isolated. Insurance processing is a deep transaction, affecting many levels of a system, and details matter throughout the full stack of the system. The risk for a microservice, even a great one, is that isolation may limit its overall value – not to mention that it may require outside orchestration to support the critical functions of the insurance process.

The strength of a full-suite solution, on the other hand, is that the orchestration and depth of each transaction is handled for you by a complete solution, ideally one with single-point-of-change capability. However, many full-suite solutions are largely canned, not separable into unique services, and only offer a limited set of user interactions and experiences.

What P&C insurers really need is a best-of-both-worlds strategy; core systems, available independently or as a full suite, that expose all their capabilities as services – and in which those services support the orchestration of the deep transactions of insurance. This is most visible in the policy administration space, as selling and servicing policies are the actions most in need of the best of both capabilities. Plus, with customer expectations changing rapidly, insurers are racing to keep up with demand for world-class user experiences and automated, data-driven upselling and cross-selling. The need to connect with insurtechs and services to build a holistic, customer-centric technological foundation for a carrier’s business is more urgent now than ever.

It’s time to invest in core systems built on a platform architected for change, openness, and speed – one that offers the capabilities carriers need regardless of whether they use a single component or a full software suite. It’s time for carriers to chart their own futures and stop following the path of the pendulum.