Because customers are redefining how they want to do business, insurance carriers are reconsidering what constitutes “insurance core systems,” with critical competitive implications for consumers, agents, and insurers.

Because customers are redefining how they want to do business, insurance carriers are reconsidering what constitutes “insurance core systems,” with critical competitive implications for consumers, agents, and insurers.

“Insurance is a people business”—you’ve heard that a thousand times. And yet conceptually and technologically, most insurers consider back-office systems and risk data as the central asset to their operations. Until recently, the best carriers offered access to data for customers—meaning agents and CSRs—with the intent of streamlining customer interactions and reporting.

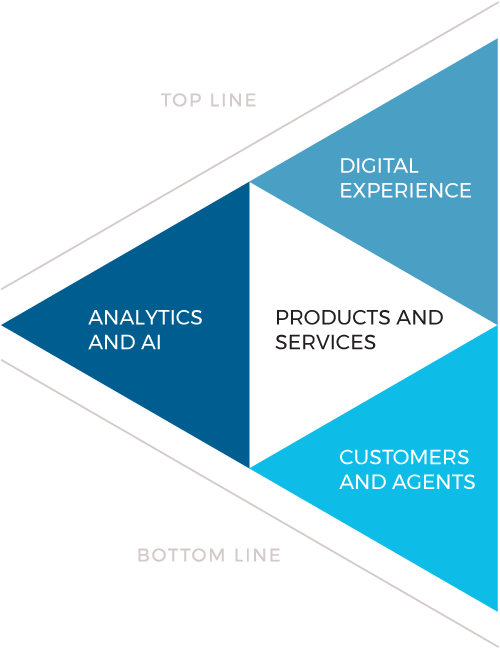

If they’re really going to succeed, however, carriers now understand that they have to think about more than just policy, claims, billing, and servicing or back-office operations. As insurers warmed to the idea of directly managing customers—in this case, insurance end users—they layered on portals and analytics.

Now customer and channel data is increasingly external, and portals and analytics are maturing and converging. This is prompting new thinking about the customer and agent experience, and how to place consumers at the center of the business to deliver an exceptional customer experience.

Today, chat, email, and apps are old tech. With the consumerization of IT, customers are doing business via chatbots, smart speakers, and smartphones, and they are eager to serve themselves with that technology. To offer all that, and whatever comes next, insurers now need openness, access to external data, and the ability to make sense of it all quickly. That means they’ll need analytics, Natural Language Processing, or even artificial intelligence, and a platform from which to digitally engage with the world. That’s the next digital customer experience; that’s a digital engagement platform.

Stop Being Operations-Centric. Start Being Customer-Centric

Let’s talk about the technology for a moment, starting with the word “portal.” It conjures the image of a tiny window on a big ship. In our world, it’s a gateway to back-end operations, and it’s been focused on the transactional aspects of the business. Customer-centric insurers realize that a portal into back-end operations is no longer sufficient for technology-enabled consumers, who are enjoying excellent customer experiences elsewhere.

When you become truly customer centric, you realize that your customer isn’t going to sit there and answer a hundred questions or more just so you can determine price and coverage. You may get three or four answers from them before they lose interest—and go looking for a provider that offers ease and speed.

That’s because excellent customer experiences increasingly are dependent on consumer technology, which obviously is external, as is related data – from information brokers, telematics and IoT devices, service providers, etc. What soon will matter most to insurers is the openness and configurability of their new core systems, and their ability to “play nicely” with those external systems and data. A next-generation digital engagement platform won’t be dependent on legacy back-end operations; nor will it care how complicated it is to determine risk and coverage, how long it takes to do so, or whether your inputs are manual or automated.

When the customer is all-important, a customer engagement platform becomes part of your core. So, how will we make the leap from portal to engagement? It’s going to be through design that gives insurers the tools they need to focus on content, marketing, and customer satisfaction, and it’s going to be driven by data to achieve that with flexibility and configurability at the product and service levels.

The carrier of the future will need industry-leading digital engagement tools, a 360-degree view of a customer’s entire data set throughout their journey with their carrier, and an integrated technology suite that seamlessly passes all of this data through every phase of an insurer’s relationship with their customers. As consumers demand more from insurers, and emerging technologies enable carriers to deliver on that demand, the path to future success will depend upon adopting these tools and using them to innovate faster than ever before.