For most people, insurance ranks as one of their top two to three expense categories, yet few policyholders get joy from having insurance and most importantly, don’t look forward to using it and filing a claim.

In fact, when they do, it’s often one of the worst periods of their lives: maybe they’ve been in an automobile accident, their home has burned down, or they have suffered an injury at their workplace. It’s a difficult fact that makes the claims experience unique.

Whatever the event, emotional trauma often exceeds financial loss. This is further compounded by the fact that some aspects of insurance are complicated and most claimants rarely (if ever) file a claim.

Helping claimants navigate the emotional and sometimes complicated process of filing a claim and restoring their lives is critical to meeting the promise of insurance and ensuring a positive customer experience – which, according to J.D. Power, is the biggest determinant of whether they’re going to renew.

A balancing act: empathy and expectations

All of this comes at a time when insurance carriers are handling more claims virtually, due to restrictions imposed by the Covid-19 pandemic and new policyholder expectations driven by experiences with other services.

It’s not surprising then, that carriers need to strike a fine balance: boosting operational efficiency by automating as much of the claims process as possible, while showing genuine, human empathy to the policyholder during a difficult, sometimes life-changing time.

Two recent studies show why a well-thought-out digitization strategy must blend the human element with technological innovation:

- The 2021 Future of Claims Studyby Lexis Nexis highlighted important, related facts:

- Almost 100% of automobile claims were handled virtually during the Covid pandemic, and settled to a little over 60% afterwards

- The percentage of claimants that rated their experience as “Very satisfied” dropped 11% overall during this period, when compared to the previous study in 2019

- Forrester 2021 report, The Claim: Where Humans Still Rule Over Machines, concludes that “ Technology has reduced cycle times and has improved some operations, especially by reducing the manual workload for claims professionals. But those behind-the-scenes efficiency gains are not visible to consumers, who are filing a claim because something traumatic has happened to them. They still crave the reassurance that someone at their insurance company hears them.”

Report author Ellen Carney summarized, “The kinds of capabilities that need investments are ones that make the desk adjuster or the claims adjuster be more effective in delivering an empathetic experience.”

The clear message from both of these studies, is that the Covid pandemic accelerated the adoption of virtual claims processing, a trend that is here to stay. However, the urgent need to support claimants under lockdown prioritized efficiency over empathy and the customer experience.

Watch, learn, engage

With the lessons learned from early virtual processing, insurers can now select new virtual technologies and tools that blend well with the human element in claims processing

A great example of a new technology that allows carriers to humanize the digital claims experience at scale while they optimize the process, is Personalized Interactive Video, that appeals to the unique way our brains process visual and audio information to come as close as possible to having a human conversation.

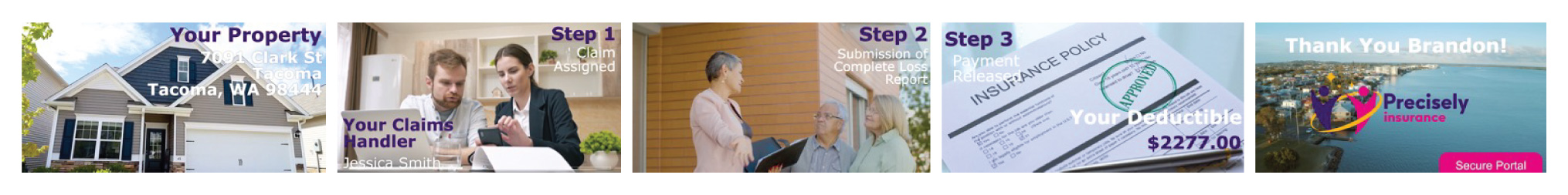

See how Duck Creek Claims and a Personalized Interactive Video humanizes the claims experience by showing empathy and helping them understand the process:

As the popularity of online video has exploded on platforms like YouTube and TikTok, it only makes sense for carriers to leverage video technology – making complex information easier to understand in the process.

For more information on this topic, listen to this recent episode of the Conversations on the Creek podcast or talk to your Duck Creek Account Executive for more information on how you can strike the perfect balance while humanizing the claims experience.